Takaful – Mudarabah Model

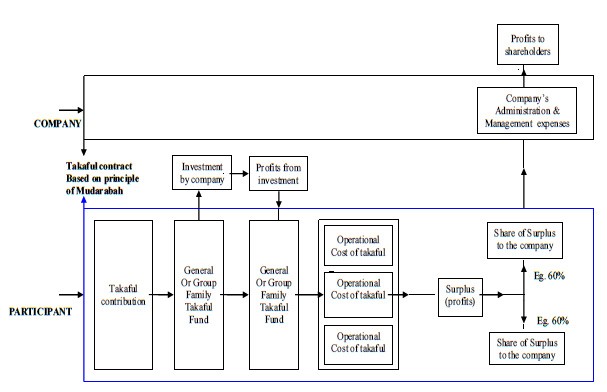

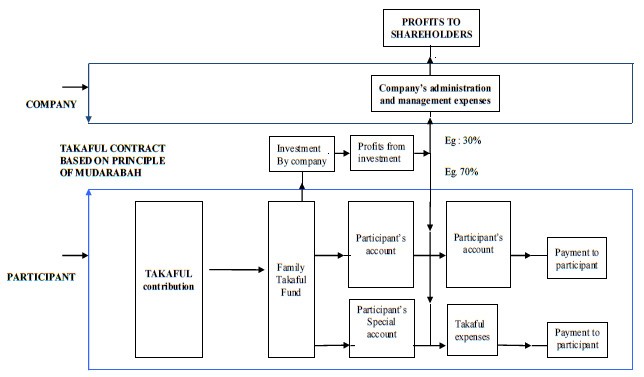

Basically, Mudarabah is defined as a profit-and-loss sharing principle applied normally to a business or commercial contract between the party that provides the fund or capital and the party that manages the business. For takaful this would mean the contract of profit sharing between the takaful participants and the operator from the profit, if any, of the takaful business. Under this arrangement, a profit sharing contract is signed between the operator, as the entrepreneur or termed Mudarib who is entrusted with managing the takaful business and the participant(s) as the provider of capital, called sahib al-mal who is obliged to pay the takaful contribution as the capital or rabb al-mal. The contract will define the profit of the takaful business and the ratio to be shared between the two parties such as 50:50, 60:40 or 70:30 between the participant and operator respectively. In essence, profit in takaful is defined as returns on the investment and surplus from the underwriting in respect of the takaful funds only. Therefore this does not include profit posted by the Shareholders‟ Fund. For the family business it includes the mortality surplus to be allocated to the eligible participant as declared by the actuarial valuation at the end of every financial year. However, unlike the Mudarabah contract for Islamic banking product, profit sharing in takaful will be undertaken only after all the obligations of takaful have been accounted for: the biggest factor is claim. In the event of a loss or deficit of the takaful fund, the loss will be borne wholly by the participant(s) as provider of capital.

Notwithstanding the above, it is the responsibility of the operator to safeguard the interest of the participants in order to ensure the business will not be seriously affected by the loss that might jeopardize the credibility and confidence of takaful as a whole. For this reason proper governance, prudence and professionalism in managing the business on the part of the operator is imperative. In the event of such loss, it is incumbent upon the operator to make good the loss by qard or loan by the shareholders. An important feature to note is that under the Mudarabah model, management expenditure is not charge on the takaful fund instead it is borne by the shareholders‟ fund. Revenue of the latter is its portion from the profit sharing of the takaful funds with the participants, and all returns on the investment of the shareholders fund itself.

General Takaful Mudarabah Model Chart

Family Takaful Mudarabah Model Chart

Therefore, under the above business model, the participant and the operator enter into a contract of the Mudarabah from inception, for indemnification and share of the underwriting profit. The fact that management expenses are not charged to the takaful fund provides better opportunity for the positive underwriting performance. As an example, management expense ratio for the conventional insurance industry in Malaysia is more than twenty (20) percent of the premium before taking into account agency remuneration. Life insurance is said to be as high as eighty (80) percent of first year premium with management expenses and agency remuneration combined. Without these expenses charged to the fund, takaful operators practising the Mudarabah model, as seen in Malaysia and Brunei, have been able to share the underwriting profit with the participants. Although the actual profit payable to each entitled participant would vary according to the profit sharing ratio and period of participation as well as the time of payment of the contribution, in general the above business model has been paying attractive share of profits to its participants. Similarly, as there is no upfront leakage of the instalment contribution to cover management expenses or agency cost, a participant of a long-term family product would be refunded all the instalment meant for his savings inclusive of its returns on investment should he chose to cancel or surrender the participation in the first year. In this regard, the unique difference of takaful against the conventional insurance is very clear. The difference is not only from the underlying basis of contract or aqad that is founded on Shariah, but also from the business operation which is advantageous to the consumers. The late (Allahyarham) Tan Sri Dato‟ Professor Ahmad Mohamed Ibrahim, Chairman of the Task Force to Study the Establishment of an Islamic Insurance Company in Malaysia, once remarked that under the system of Islamic insurance users and consumers of the system, participants would not loose their premium whilst at the same would have the opportunity of free cover.

Nonetheless, some scholars and Islamic jurisprudents expressed concern on the suitability of applying the Mudarabah contract for takaful operation. According to them, it is not appropriate to link a contract of tabarru. between participants to profit sharing of Mudarabah. It is argued that donation cannot be profit sharing at the same time. Another aspect of their concern is that sharing of the underwriting surplus tantamount to making takaful into a commercial business venture instead of a contract of mutuality and joint protection.

However, the view of scholars and Islamic jurisprudents, in particular those who have been serving on the Shariah bodies of various takaful operators in Malaysia, supporting the permissibility of the above model is based on the legal maxim where a ruling is decided based on the understanding of the issue. In this regard, one of the approaches used is the principle of .urf as one of the secondary sources of Shariah. In Shariah Resolutions in Islamic Finance published by Bank Negara Malaysia, .urf is defined:

“... as established norms and common to the majority of people in a community either in the form of sayings or doings. It is a common customary practice which is accepted and applicable as a legal basis of ruling as long it does not contradict the Shariah ruling. In the context of Islamic banking and finance, urf iqtisadi (a common business practice is considered as a basis of Shariah rulings... “

Guided by the above, the model recognises contributions paid by participants as ra.sul-mal and only in the event of a loss incurred on the donation contract on the basis of tabarru. It is the urf for General Takaful that the actual tabarru. cannot be determined at the inception of the contract until a loss occurs. Similarly, it is also the urf, that profit of the General Business includes underwriting surplus for which in the conventional operation it belongs to the shareholders. As the surplus forms part of the profit, under the takaful structure it will be subjected to profit sharing to enable the operator to pay for its management expenses and should there be any balance thereof to be declared as dividends to its shareholders. The transaction as a whole does not breach the doctrines of adl and ihsan.

EXCERPTS FROM: Mohd Fadzli Yusof, Fundamentals of Takaful (Kuala Lumpur: IBFIM, 2011), pp 29 to 44