Islamic REITs

The first Islamic REIT (Real Estate Investment Trust) in the world was Malaysia-based Al-Aqar KPJ REIT, launched on June 2006. [1] Al-Aqar KPJ REIT initial investment were six hospitals valued at USD 138 million. The second Islamic REIT was also Malaysia-based, Al-Hadaharah Boustead REIT, with initial investment in palm oil plantation estates valued at USD 136 million and was launched on February 2007. The third Islamic REIT and world’s first Islamic industrial/office REIT was the Malaysia-based AXIS REIT. AXIS REIT was initially launched as conventional REIT in August 2005 but subsequently restructured to be Shariah-compliant in December 2008. [2] In May 2013, Malaysia issued world’s first stapled REIT, KLCC REIT. A stapled REIT is an investment vehicle which ‘stapled’ two or more entities/instruments into a new financial instrument. [3]

Even Singapore has issued its first Islamic REIT, Sabana REIT, and subsequently listed it on the Singapore Exchange Securities Trading Limited in 2010. [4] As of third quarter 2013, Sabana REIT portfolio consisted of 22 properties valued at SGD 1.22 billion, making it the world’s largest Islamic REIT. [5] Yet, as of this writing, Indonesia being the largest Muslim populated country in the ASEAN region has not issued any Islamic REIT.

Currently there are no specific regulations concerning Islamic REIT in Indonesia, although OJK (Financial Services Authority) has indicated in their Shariah Capital Market Roadmap that such regulation is in the planning and may be released in the near future. [6] Globally there are four types of REIT: equity REIT, mortgage REIT, hybrid (equity and mortgage) REIT, and stapled REIT. Indonesian regulations do not allow for mortgage REIT yet, and stapled REIT does not exist yet despite its possibility under current regulations (for the sake of relevancy, the REIT meant by this article is of equity type).

Shariah-compliant and Shariah-based Islamic REITs

It may also be useful to note the argument between Shariah-compliant and Shariah-based (driven) approach in the creation of a financial instrument. Although this article does not delve into the philosophical underpinning of both approaches, it shall attempt to explain the differences and related aspects. Aznan bin Hasan described that Shariah-based perspective is “where the asset used in Islamic products are really transacted on, not only used as ‘conduit’ to obtain the same results of the conventional products”, while Shariah-compliant perspective is where “asset used may be utilized to reach the same effect like the conventional products”. While Hasan illustration applies to financing instruments, similar understanding can analogously be applied to REIT as well.

In Shariah-compliant REIT, the REIT is considered to fulfil Shariah Principle in Capital Market as long as there is no breach to the Principle even when the REIT is designed as a conventional investment instrument. For example, a conventional industrial estate REIT may be deemed Shariah-compliant if there are no Shariah prohibited goods manufactured in the vicinity, no conventional borrowing is undertaken by the REIT, and that the REIT does not undergo Shariah prohibited transactions. It can be analogous to Shariah-compliant shares. In this case, the REIT would be listed under Shariah-compliant Securities List (DES) similar to ordinary shares. However, should the REIT undertake conventional interest-based loan to acquire new property, for example, then it would be delisted from DES until the loan is paid.

In Shariah-based REIT, the REIT is designed to be Shariah instrument from the initial construction, so that it shall fulfill Shariah Principle in Capital Market and be listed in DES at all time. For example, a Shariah hotel REIT is made with Shariah Supervisory Board (DPS) at the hotel level and REIT level to ensure Shariah-compliancy of the operating hotel and the REIT structure at all time. Hence, the hotel management has to ensure that no alcohol is served on the premise and ensure that non-mahram guests of opposite gender to be husband and wife, for example. This REIT can be analogous to Sukuk. Hence, it is unlikely that Shariah-based REIT would be jettisoned from DES due to its design and Shariah supervision.

The term Islamic REIT is also interchangeable with Shariah-compliant REIT.

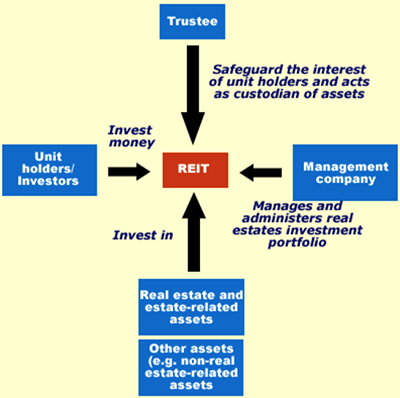

Figure 1: Typical Structure of Islamic REITs

Source: Azmi & Associates.

Prohibitions in Islamic REITs

The following list outlines prohibited criteria of Islamic REIT: [7]

- General prohibition of hotels and resorts (except explicitly operated as Shariah establishment).

- General prohibition of riba-based financial services. This can mean riba-based financial services as tenants of a mal, for example, or riba-based financial transaction used by REIT such as conventional loan undertaken for new property acquisition as illustrated in prior example above. [8]

- General prohibition of conventional insurance. This can also mean conventional insurance as tenants of an office building, for example, or conventional insurance used by REIT to insure the building.

- General prohibition against alcohol, tobacco (based on international fatwa), gaming, gambling, and other haram goods and services. This can mean no building tenants having the aforementioned business activities. This prohibition can go wider as other goods and services, which have mudarat (harmful) effect to the general public, are also off-limit. [9]

Since REIT is allowed to invest in Real Estate related assets, they have to fulfil Shariah Principle in Capital Market as well, and be listed in DES if applicable (such as Sukuk and Shariah-compliant stocks).

The above list may be seen as theoretical simplification as in many real cases there are less clear cut instances where a multi-lease commercial property may include a small branch of conventional bank or a conventional insurance agency office or a supermarket selling tobacco or a fine dining restaurant serving alcoholic beverages or in any combination. Shariah scholars generally allow for multi-lease properties to have non-permissible activities as long as they are below a certain threshold. [10]

The income received from non-permissible activities, such as in the example above, shall be taken out from REIT’s operation and may be donated to charity. The ‘cleansed’ income would then be distributed to investors.

Ijtihad of Shariah scholars may be needed in determining acceptable technique to calculate threshold ratio. Several approaches are available such as utilization of occupied space, length of service hours, portion of revenues, and number of traffic. Different asset may require different threshold calculation approach.

Ijtihad of Shariah scholars may be needed in determining acceptable technique to calculate threshold ratio. Several approaches are available such as utilization of occupied space, length of service hours, portion of revenues, and number of traffic. Different asset may require different threshold calculation approach.

Analogous to the definition of Reksa Dana Syari’ah (Shariah-compliant Mutual Fund) in Fatwa DSN-MUI 20/2001, Islamic REIT has to abide by the principle and regulation of Shariah law. The form of aqad are: 1) between REIT Participation Unit Holder as the capital provider (Shahib al-mal/Rabb al-mal) with investment manager, and 2) between investment manager as the agent (wakil) of Shahib al-mal and the investee (commercial property manager). [11]

Contracts - Islamic REITs

Mudharabah aqad is chosen as the contract between the investment manager as a wakil of Shahib al-mal with the property manager because of its characteristics:

- Sharing of profits between the investor (Shahib al-mal), through agency of the investment manager, and the investee (property manager) is according to the agreed proportion by both parties and that there will be no guarantee of fixed return to the investor.

- Investor only shares the risk proportionate to the capital contributed.

- Property manager does not bear risk of loss to the investment as long as no gross negligence (tafrith) is conducted on its part.

Alternatively, ijarah aqad can be used where investor (Shahib al-mal), through investment manager, receives rental payment from property manager for the use of the property. The property manager may sub-lease the property to other tenants and may use cost plus margin as the tenants’ rental rate. Advantage of ijarah aqad is the relatively constant (less fluctuative) return for the investor as the spread risk is borne by the property manager.

If the property manager was the previous owner of the commercial property prior to its purchase by Islamic REIT, then the aqad is ijara sale and leaseback, as the property owner sold the property to the REIT and then lease it back from the REIT.

The aqad between investor and its agent (investment manager and custody bank) is conducted through wakala bil-ujrah (agency for fees). Fatwa DSN-MUI 20/2001 article 3 stipulates this for Shariah-compliant mutual fund, which may be analogous to Islamic REIT. The investor gives a mandate to investment manager to invest on behalf of the investor (and to custody bank to safe keep on his/her behalf) in accordance with the terms and condition stipulated in the prospectus (for public REIT) or the information memorandum (for private REIT).

In its Shariah Capital Market Roadmap, OJK has indicated that legal framework for Islamic REIT may be released in the near future as part of its effort to strengthen regulatory framework for Shariah Capital Market in general. As an attempt to widen investor base and participation, more effort may be offered, namely incentive for Islamic REIT. OJK has showed such support for mainstream Shariah-compliant investment instruments, such as mutual fund, with the release of OJK Regulation 19/2015 on Issuance and Requirement for Shariah Mutual Fund, where incentives given include lower minimum asset under management (IDR 10 billion vs IDR 25 billion for conventional mutual fund), higher cap on single security allocation (20% vs 10% for conventional mutual fund), and foreign securities allowance (up to 100% vs 15% for conventional mutual fund). Similar incentives may be given to Islamic REIT, for example: lower income tax, allowance for foreign Real Estate related asset (including units of foreign Islamic REITs), and exemption for property owner from MoF Regulation 191/2015. [12]

Such incentives may require coordination by OJK with other Government bodies, but it is expected to enable supply increase with the rise of REIT, and specifically Islamic REIT, issuance.

References:

[1] Insights (2013). Islamic Real Estate and Investment Trusts (Islamic REITs): A promising asset class for wealth management, Bank Negara Malaysia, Kuala Lumpur, Malaysia.

[5] International Shari’ah Research Academy for Islamic Finance (ISRA) (2015), Islamic Capital Markets: Principles & Practices, Pearson, Kuala Lumpur, Malaysia.

[6] Direktorat Pasar Modal Syariah Otoritas Jasa Keuangan (2015), Roadmap Pasar Modal Syariah 2015-2019 [Shariah Capital Market Roadmap], Otoritas Jasa Keuangan, Jakarta, Indonesia.

[7] The list is derived from the activities and underlying business in contrary to Shariah Principle in Capital Market. For a more extensive description, please refer to OJK Regulation 15/2015 on Implementation of Shariah Principle in Capital Market, Bapepam-LK Regulation II.K.1 on Criteria and Issuance of Shariah compliant Securities List, and Fatwa DSN-MUI 40/2003 on Capital Market and General Guideline for the Implementation of Shariah Principle in Capital Market.

[8] Bapepam-LK Regulation II.K.1 stipulates total interest-bearing debt over total asset at maximum to be 45%. While this regulation applies to issuers for inclusion in DES, an analogy to REIT may be made.

[9] OJK Regulation 15/2015 article 2 section 1 sub-section d.3

[10] While non-permissible activities are prohibited, as long as they do not comprise the primary usage and revenue of the property, they are still allowed by regulators and scholars. Bapepam-LK Regulation II.K.1 stipulates total non-halal income (including conventional interest income) to be at maximum 10%. While this regulation applies to issuers for inclusion in DES, an analogy may be made for REIT. For comparison, Securities Commission Malaysia (Insights: 2013) sets the threshold at 20% in any current financial year.

[11] Article 2 of the Fatwa describes the operational mechanism of Shariah-compliant mutual fund, consisting of:

- Between investor and Investment Manager, it is conducted through waqala aqad.

- Between Investment Manager and investee, it is conducted through mudharabah aqad.

[12] Ministry of Finance Regulation 191/2015 is an implementing regulation to the Government’s fifth fiscal policy announced on 22 October 2015 regarding temporary tax relaxation for revaluation of fixed asset. The Government allows for lower tax rate (3% up to 31 December 2015, 4% up to 31 June 2016, and 6% up to 31 December 2016 in lieu of 10% existing rate) on unrealized (book value) gain resulting from fixed asset revaluation. The Regulation disallow subsequent revaluation within a 5-year period afterward, while sale of the revalued property within a 10-year period afterward shall render the tax relaxation invalid, as such requiring property owner/seller to pay the remaining tax owed under the 10% rate.

Source: Edited version of: Islamic Real Estate Investment Trust as an Investment Asset for Waqf Management in Indonesia: Regulatory Framework and ShariahCompliancy, By Yoga Prakasa.