AAOIFI Standards

Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) is an independent industry body dedicated to the development of international standards applicable for Islamic financial institutions. The Bahrain-based organisation started producing standards as early as 1993.

Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) is an independent industry body dedicated to the development of international standards applicable for Islamic financial institutions. The Bahrain-based organisation started producing standards as early as 1993.

AAOIFI standards have been developed in consultation with leading Sharia scholars, with several counties adopting them. Although AAOIFI standards are not binding on members, over the last few years the organisation has made significant progress in encouraging the widespread adoption of the standards.

Countries where AAOIFI standards are either mandatory or recommended include: Bahrain, Malaysia, UAE, Saudi Arabia, Lebanon, Syria, Sudan and Jordan. Prior to implementation of AAOIFI standards many financial institutions in these countries were operating under a “semi-regulated market” (Al Baluchi, 2006), where accounting policies were determined with the assistance of the bank’s Sharia Supervisory Board (SSB). In addition, over this period, International Accounting Standards (IAS) or respective national accounting standards were followed by Islamic banks. Hence, the unique requirements of Islamic financial institutions were not being met. To give two examples:

- Fiduciary risk: the Mudaraba contract places liability of the loss on the mudarib.

- Displaced commercial risk: where Islamic banks “smooth” the returns Investment Account Holders (IAH) by varying the percentage of profit taken as Mudarib share.

As a result, with the support of banking authorities, AAOIFI standards were created. In an industry that is often quite fragmented, it is hoped that the development of AAOIFI standards will go a long way in promoting convergence in Sharia standards and leading to further growth in this nascent market.

AAOIFI Standards – The following standards have been developed by AAOIFI:

Accounting Standards:

1. Objective of financial accounting for Islamic banks and financial institution (IFIs).

2. Concept of financial accounting for IFIs.

3. General presentation and disclosure in the financial statements of IFIs.

4. Murabaha and Murabaha to the purchase orderer.

5. Mudaraba financing.

6. Musharaka financing.

7. Disclosure of bases for profit allocation between owners’ equity and investment account holders.

8. Equity of investment account holders and their equivalent.

9. Salam and Parallel Salam.

10. Ijarah and Ijarah Muntahia Bittamleek.

11. Zakah.

12. Istisna’a and Parallel Istisna’a.

13. Provisions and Reserves.

14. General Presentation and Disclosure in the Financial Statements of Islamic Insurance Companies.

15. Disclosure of Bases for Determining and Allocating Surplus or Deficit in Islamic Insurance Companies.

16. Investment Funds.

17. Provisions and Reserves in Islamic Insurance Companies.

18. Foreign Currency Transactions and Foreign Operation.

19. Investments.

20. Islamic Financial Services Offered by Conventional Financial Institutions.

21. Contributions in Islamic Insurance Companies.

22. Deferred Payment Sale .

23. Disclosure on Transfer of Assets.

24. Segment Reporting.

25. Consolidation.

26. Investment in Associates.

Auditing Standards:

1. Objective and principles of auditing.

2. The Auditor’s Report.

3. Terms of Audit Engagement.

4. Testing for Compliance with Shariaa Rules and Principles by an External Auditor.

5. The Auditor’s Responsibility to Consider Fraud and Error in an Audit of Financial Statements.

Governance Standards:

1. Sharia Supervisory Board: Appointment, Composition and Report.

2. Sharia Review.

3. Internal Sharia Review.

4. Audit and Governance Committee for IFIs.

5. Independence of Sharia Supervisory Board.

6. Statement on Governance Principles for IFIs.

7. Corporate Social Responsibility.

Ethics Standards:

1. Code of ethics for accountants and auditors of IFIs.

2. Code of ethics for employees of IFIs.

Sharia Standards:

1. Trading in currencies.

2. Debit Card, Charge Card and Credit Card

3. Default in Payment by a Debtor.

4. Settlement of Debt by Set-Off.

5. Guarantees.

6. Conversion of a Conventional Bank to an Islamic Bank.

7. Hawala.

8. Murabaha to the Purchase Orderer.

9. Ijarah and Ijarah Muntahia Bittamleek.

10. Salam and Parallel Salam.

11. Istisna’a and Parallel Istisna’a.

12. Sharika (Musharaka) and Modern Corporations.

13. Mudaraba.

14. Documentary Credit.

15. Jua’la.

16. Commercial Papers.

17. Investment Sukuk.

18. Possession (Qabd).

19. Loan (Qard).

20. Commodities in Organised Markets.

21. Financial Papers (Shares and Bonds).

22. Concession Contracts.

23. Agency.

24. Syndicated Financing.

25. Combination of Contracts.

26. Islamic Insurance.

27. Indices.

28. Banking Services.

29. Ethics and stipulations for Fatwa.

30. Monetization (Tawarruq)

31. Gharar Stipulations in Financial Transactions

32. Arbitration

33. Waqf

34. Ijarah on Labour (Individuals)

35. Zakah

36. Impact of Contingent Incidents on Commitments.

37. Credit Agreement

38. Online Financial Dealings

39. Mortgage and its Contemporary Applications.

40. Distribution of Profit in Mudarabah-based Investments Accounts.

41. Islamic Reinsurance

42. Financial Rights and Its Disposal Management

43. Liquidity and Its Instruments

44. Bankruptcy

45. Capital and Investment Protection

To purchase Accounting, Auditing & Governance Standards (for Islamic Financial Institutions), English version, please visit: http://www.aaoifi.com

AAOIFI Standard on Gold

Dr. Mohd Daud Bakar:

AAOIFI has been issuing more than 50 Shariah Standards already. This Shariah standard on gold wouldn’t be the first and the last. As such, what is so special about this standard? Allow me to share some of the insights that I am able to discover while working on this Shariah standard from day one.

First things first. It is essentially meant to be a stand-alone standard in the sense that you can find as many relevant principles of Shariah on gold as possible in one standard. It seems that the initial drafters and the AAOIFI sub-committee of the standard have the motivation to compile almost all relevant rulings dealing with gold under this standard. It will be easier for the readers then to know the overall Shariah prescriptions without referring to many other Shariah Standards of AAOIFI found elsewhere. In other Shariah Standards, many of the Shariah issues, if already covered by other Shariah Standards, will be straight-away referred to that Shariah Standard so that the reader may need to flip through relevant Shariah Standards to get what they need to know.

Read more: https://www.islamicmarkets.com/articles/aaoifi-shariah-standard-on-gold

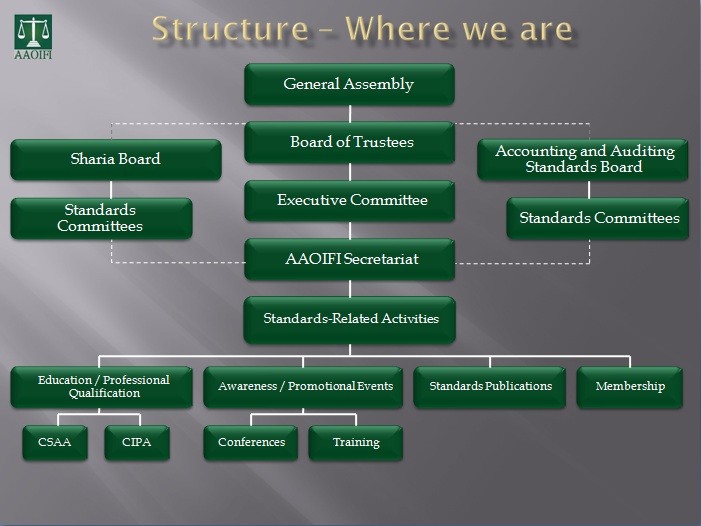

AAOIFI Structure