Sukuk Al-Mudaraba

When structuring a sukuk issuance, the first step is often to analyse what exactly the business of an originator entails and what assets (if any) are available to support the issuance of sukuk. If at the outset, it is not possible to identify a specific tangible asset for investment, the sukuk al-mudaraba (or a sukuk al-musharaka) may be a viable alternative to the sukuk al-ijara structure.

In the Islamic finance industry, the term mudaraba is broadly understood to refer to a form of equity-based partnership arrangement whereby one partner provides capital (the Rab al-Maal) and the other provides managerial skills (the Mudarib).

The same characteristics of the mudaraba structure can also be adapted for use as the underlying structure in a sukuk issuance as each Investor’s purchase of sukuk would represent units of equal value in the mudaraba capital, and are registered in the names of the sukuk certificate holders on the basis of undivided ownership of shares in the mudaraba capital. The returns to the Investors would represent accrued profit from the mudaraba capital at a pre-agreed ratio between the Rab al-Maal and the Mudarib, which would then pass to the Investors according to each Investor’s percentage of investments in sukuk mudaraba. Examples of recent sukuk al-mudaraba issuances and advised upon by Clifford Chance LLP are:

- SAR1 billion issuance by Purple Island/Bin Laden in November 2008 (no purchase undertaking)

- Abu Dhabi Islamic Bank’s AED2 billion Tier I issuance issued in February 2009 (no purchase undertaking);

- DP World, US$1.5 billion issued in July 2007, which was part of a US$5 billion global medium term note programme; and

- IIG Funding Limited, US$200 million issued in July 2007 and listed on NASDAQ Dubai.

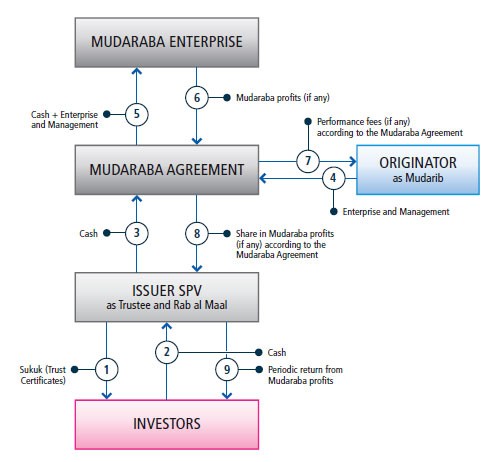

Figure 1: Structure of Sukuk al-Mudaraba

Overview of Structure

- Issuer SPV issues sukuk, which represent an undivided ownership interest in an underlying asset, transaction or project. They also represent a right against Issuer SPV to payment of expected periodic return from Mudaraba profits

- The Investors subscribe for sukuk and pay the proceeds to Issuer SPV (the “Principal Amount”). Issuer SPV declares a trust over the proceeds (and any assets or Mudaraba interests acquired using the proceeds) and thereby acts as Trustee on behalf of the Investors.

- Issuer SPV and Originator enter into a Mudaraba Agreement with Originator as Mudarib and Issuer SPV as Rab al- Maal, under which Issuer SPV agrees to contribute the Principal Amount for the purpose of a Shari’a compliant Mudaraba enterprise.

- Originator, as Mudarib under the Mudaraba Agreement, agrees to contribute its expertise and management skills to the Shari’a compliant Mudaraba enterprise, with responsibility for managing the Rab al-Maal’s cash contribution in accordance with specified investment parameters.

- Issuer SPV and Originator enter into the Mudaraba enterprise with the purpose of generating profit on the Principal Amount.

- Profits generated by the Mudaraba enterprise are divided between Issuer SPV (as Rab al-Maal) and Originator (as Mudarib) in accordance with the profit sharing ratios set out in the Mudaraba Agreement but accrued for the duration of the Mudaraba enterprise

- In addition to its profit share, Originator (as Mudarib) may be entitled to a performance fee for providing its expertise and management skills if the profit generated by the Mudaraba enterprise exceeds a benchmarked return. This performance fee (if any) would be calculated at the end of the Mudaraba term and upon liquidation of the Mudaraba.

- Issuer SPV receives the Mudaraba profits and holds them as Trustee on behalf of the Investors. I

- Issuer SPV (as Trustee) pays each periodic return to Investors using the Mudaraba profits it has received under the Mudaraba Agreement

On maturity of the sukuk al-mudaraba, the Mudaraba enterprise would be dissolved in accordance with the terms of the Mudaraba Agreement and the Trustee would exercise a purchase undertaking to call on Originator to buy the Mudaraba interests from the Trustee at market value so that the proceeds can be used to service the outstanding amounts due to the Investors. The Investors would be entitled to a return comprising their pro rata share of the market value of the liquidated Mudaraba capital and the profit generated by the Mudaraba enterprise and accrued during the term of the sukuk issuance.

Upon maturity, the assets of the Mudaraba enterprise would be liquidated and the proceeds would be applied: firstly, in the return of the capital initially contributed by Issuer SPV; and secondly, in the distribution of any remaining dissolution returns between Issuer SPV and Originator in accordance with the same profit sharing ratios. Issuer SPV (as Trustee) then pays such dissolution returns to the Investors redeeming the sukuk certificates.

Although the profits generated during the term of the Mudaraba enterprise are accrued for distribution on dissolution at maturity, periodical distributions to Investors may nonetheless be achieved during the term of the sukuk issuance through payments of “advance profits”. This would typically be effected by way of a constructive liquidation of the Mudaraba assets at specified intervals whereby the amounts of advance profit would represent the difference between:

- the market value of the Mudaraba assets on the relevant constructive liquidation date; and

- he par value of the Mudaraba (ii) assets

Key Features of the Underlying Structure

Set out below is a summary of the basic requirements that should be considered when using mudaraba as the underlying structure for the issuance of sukuk:

- Originator (as Mudarib) discharge and performs its obligations under the Mudaraba Agreement with the degree of skill and care that it would exercise in respect of its own assets;

- An investment plan in respect of the Mudaraba enterprise will be tailored within Shari’a parameters to meet the financing objectives of the sukuk al-mudaraba as set out in the Mudaraba Agreement (the terms of which would also be specified in the sukuk prospectus)

- The Mudaraba would be entered into on a restricted basis (an al-mudaraba al- muqayyadah) in which Originator (as Mudarib) must invest the sukuk proceeds in accordance with the specified investment plan. For Shari’a purposes, at least 33% of the capital of the Mudaraba enterprise should be invested in tangible assets (also known as the asset-backing ratio or tangibility requirement) at all times;

- The profit sharing ratio between Issuer SPV (as Rab al-Maal) and Originator (as Mudarib) must be agreed at the time of the conclusion of the Mudaraba Agreement, but this cannot be expressed as a rate based on each party’s contribution in the Mudaraba enterprise nor as a pre-agreed lump sum;

- Any losses of the Mudaraba enterprise would be borne by Issuer SPV (as Rab al- Maal), although its liabilities are limited to proceeds invested (therefore, Investors would not be liable for more than their investment into the sukuk al-mudaraba); and

- The risk of passing any losses of the Mudaraba enterprise to Investors may be mitigated through the use of a purchase undertaking granted by Originator (as Promissor) in favour of Issuer SPV (as Promisee) so that in the event that proceeds from the Mudaraba enterprise are insufficient in meeting any amounts payable by Issuer SPV to Investors, Issuer SPV may call on Originator to purchase its Mudaraba interests for a price which represents their market value

Required Documentation

The following documentation is typically required for a sukuk al-istithmar transaction:

| Document | Parties | Summary / Purpose |

|---|---|---|

| Mudaraba Agreement | Originator (as Mudarib) and Trustee (as Rab al-Maal) | Sets out the terms of the Mudaraba enterprise under which the Trustee shall invest the Principal Amount and prescribes the profit sharing ratios between the parties. |

| Purchase Undertaking (Wa’d) | Granted by Originator (as Obligor) in favour of Trustee | Allows Originator to buy the Mudaraba interests from Trustee for an exercise price which is equal to the market value of such interests on the exercise date if an event of default with respect to the Originator occurs during the term of the Mudaraba enterprise or on the date of the dissolution of the Mudaraba enterprise so that Trustee may apply the proceeds to pay Investors. |

Structural Developments/AAOIFI’s Statement of 2008

Before the AAOIFI Statement it was possible for the Originator to grant a purchase undertaking in favour of the Trustee whereby the exercise price would be a fixed amount determined in accordance with a formula that would ensure that the exercise price would:

- n the event of a default or on maturity of the sukuk, be equal to the par value of the sukuk plus any accrued but unpaid Mudaraba profits;

- n the event of a shortfall between any amount actually received by the Trustee from the Mudaraba enterprise and the profits received by the Trustee and the distribution amount due to the Investors, be equal to the shortfall

rather than a formula would reference the market value of the assets of the Mudaraba enterprise. The use of such purchase undertakings, in effect, ensured that the Investors were almost certain to receive their principal sukuk investment and profit (subject to the usual risks such as insolvency present in any sukuk or conventional bond structure).

However, under the AAOIFI Statement, Shari’a scholars have taken the view that it is not permissible for an Originator to grant a purchase undertaking to the Trustee to purchase the Mudaraba assets for any amount other than the Trustee’s share of the market value of the Mudaraba assets at the time of sale. The premise for this ruling has been that sukuk al-mudaraba are analogous to equity-based instruments and therefore the partners in the Mudaraba must take the risk of both profit and loss. Determining the value of the Mudaraba assets by reference to the par value of the sukuk (or by reference to a shortfall amount) is akin to a guarantee of profit and principal which, unless given by an independent third party (a party other than the Originator), is not permitted under Shari’a. This ruling is another reason why the sukuk market has not seen a revival of the sukuk al-mudaraba structure.

Source: Dubai International Financial Centre Sukuk Guidebook