Sukuk al-Ijara

The most commonly used sukuk structure is that of sukuk al-ijara. The popularity of this structure can be attributed to a number of different factors; some commentators have described it as the classical sukuk structure from which all other sukuk structures have developed, whilst others highlight its simplicity and its favour with Shari’a scholars as the key contributing factors. In the Islamic finance industry, the term “ijara” is broadly understood to mean the ‘transfer of the usufruct of an asset to another person in exchange for a rent claimed from him’ or, more literally, a “lease”.

In order to generate returns for investors, all sukuk structures rely upon either the performance of an underlying asset or a contractual arrangement with respect to that asset. The ijara is particularly useful in this respect as it can be used in a manner that provides for regular payments throughout the life of a financing arrangement, together with the flexibility to tailor the payment profile - and method of calculation - in order to generate a profit. In addition, the use of a purchase undertaking is widely accepted in the context of sukuk al-ijara without Shari’a objections. These characteristics make ijara relatively straightforward to adapt for use in the underlying structure for a sukuk issuance.

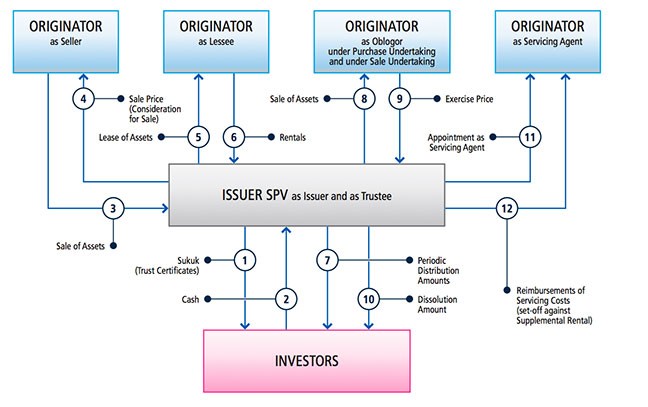

Set out below is an example of a sukuk al-ijara structure, based upon a sale and leaseback approach.

Figure 1: Structure of Sukuk al-Ijara

Overview of Structure

- Issuer SPV issues sukuk, which represent an undivided ownership interest in an underlying asset or transaction. They also represent a right against Issuer SPV to payment of the Periodic Distribution Amount and the Dissolution Amount.

- The Investors subscribe for sukuk and pay the proceeds to Issuer SPV (the “Principal Amount”). Issuer SPV declares a trust over the proceeds (and any assets acquired using the proceeds – see paragraph 3 below) and thereby acts as Trustee on behalf of the Investors.

- Originator enters into a sale and purchase arrangement with Trustee, pursuant to which Originator agrees to sell, and Trustee agrees to purchase, certain assets (the “Assets”) from Originator.

- Trustee pays the purchase price to Originator as consideration for its purchase of the Assets in an amount equal to the Principal Amount.

- Trustee leases the Assets back to Originator under a lease arrangement (ijara) for a term that reflects the maturity of the sukuk.

- Originator (as Lessee) makes Rental payments at regular intervals to Trustee (as Lessor). The amount of each Rental is equal to the Periodic Distribution Amount payable under the sukuk at that time. This amount may be calculated by reference to a fixed rate or variable rate (e.g. LIBOR or EIBOR) depending on the denomination of sukuk issued and subject to mutual agreement of the parties in advance.

- Issuer SPV pays each Periodic Distribution Amount to the Investors using the Rental it has received from Originator.

- Upon:

- an event of default or at maturity (at the option of Trustee under the Purchase Undertaking); or

- the exercise of an optional call (if applicable to the sukuk) or the occurrence of a tax event (both at the option of Originator under the Sale Undertaking),

- Payment of Exercise Price by Originator (as Obligor).

- Issuer SPV pays the Dissolution Amount to the Investors using the Exercise Price it has received from Originator.

- Trustee and Originator will enter into a service agency agreement whereby Trustee will appoint Originator as its Servicing Agent to carry out certain of its obligations under the lease arrangement, namely the obligation to undertake any major maintenance, insurance (or takaful) and payment of taxes in connection with the Assets. To the extent that Originator (as Servicing Agent) claims any costs and expenses for performing these obligations (the “Servicing Costs”) the Rental for the subsequent lease period under the lease arrangement will be increased by an equivalent amount (a “Supplemental Rental”). This Supplemental Rental due from Originator (as Lessee) will be set off against the obligation of Trustee to pay the Servicing Costs.

Key Features of the Underlying Structure

Set out below is a summary of the basic requirements that should be considered when using ijara as the underlying structure for the issuance of sukuk:

- The consideration (Rentals) must be at an agreed rate and for an agreed period;

- The subject of the ijara must have a valuable use (i.e. things without a usufruct cannot be leased);

- The ownership of the asset(s) must remain with the Trustee and only the usufruct right may be transferred to the originator (therefore anything which can be consumed cannot be leased by way of an ijara);

- As ownership of the asset(s) must remain with the Trustee, the liabilities arising from the ownership must also rest with the Trustee (as owner) - an asset remains the risk of the Trustee throughout the lease period (in the sense that any harm or loss caused by the factors beyond the control of the Originator is borne by the Trustee);

- Any liabilities relating to the use of the asset(s), however, rest with the Originator (as lessee);

- The Originator (as lessee) cannot use an asset for any purpose other than the purpose specified in the ijara (or lease) agreement (if no purpose is specified, the Originator can use such asset for the purpose it would be used for in the normal course of its business);

- The asset(s) must be clearly identified in the ijara (and identifiable in practice);

- Rental must be determined at the time of contract for the whole period of the ijara. Although it is possible to split the term of the ijara into smaller rental periods where different amounts of rent may be calculated for each such rental period, the amount of rental must be fixed at the start of each such rental period and Shari’a will consider each rental period as a separate lease;

- If an asset has totally lost the function for which it was leased, and no repair is possible, the ijara shall terminate on the day on which such loss (a “Total Loss”) has been caused. If there has been a Total Loss, the Trustee may have the right/ability to substitute or replace the affected asset - although, in reality, it would only look to do so if the Originator (as service agent) is able to use the insurance (or takaful) or any other total loss proceeds to procure substitute or replacement assets;

- If a Total Loss is caused by the misuse or negligence of the Originator, the Originator will be liable to compensate the Trustee for depreciation in the value of the affected asset, as it was immediately before such Total Loss; and

- In the event that an asset has only suffered partial loss or damage, the ijara will continue to survive with respect to that asset.

The above requirements are based on the principles set out in Accounting and Auditing Organization for Islamic Financial Institutions (the “AAOIFI”) Shari’a Standard No. 9 (Ijarah and Ijarah Muntahia Bittamleek) and other established principles relating to Ijara.

Required Documentation

| Document | Parties | Summary/Purpose |

|---|---|---|

Sale and Purchase | Originator (as Seller) and Trustee (as Purchaser) | From Trustee’s (and the Investors’) perspective, this is the document that gives ownership of revenue-generating assets (i.e. the Assets). From Originator’s perspective, this is the document under which it receives funding. |

| Lease (Ijara) Agreement | Trustee (as Lessor) and Originator (as Lessee) | Trustee leases the Assets back to Originator in a manner that: gives Originator possession and use of the i. Assets so that its principal business can continue without interruption; and through Rentals it generates a return for ii. Trustee (and the Investors). |

Service Agency Agreement | Trustee (as Lessor / Principal) and Originator (as Servicing Agent) | Allows Trustee to pass responsibility for major maintenance, insurance (or takaful) and payment of taxes (i.e. an owner’s obligations) back to Originator. Any reimbursement amounts or service charges payable to Servicing Agent are set off against (i) a corresponding ‘supplementary rental’ under the Ijara or (ii) an additional amount which is added to the Exercise Price (payable under the Purchase Undertaking or the Sale Undertaking, as applicable). |

Purchase Undertaking (Wa’d) | Granted by Originator (as Obligor) in favour of Trustee | Allows Trustee to sell the Assets back to Originator if an event of default occurs or at maturity, in return for which Originator is required to pay all outstanding amounts (through an Exercise Price) so that Trustee can pay the Investors. |

| Sale Undertaking (Wa’d) | Granted by Trustee in favour of Originator (as Obligor) | Allows Originator to buy the Assets back from Trustee in limited circumstances (e.g. the occurrence of a tax event), in return for which Originator is required to pay all outstanding amounts (through an Exercise Price) so that Trustee can pay the Investors. |

Substitution Undertaking (Wa’d) - OPTIONAL | Granted by Trustee in favour of Originator (as Obligor) | Allows Originator to substitute the Assets (which it may need to sell or otherwise dispose of) for some other assets having at least the same value and revenue-generating properties. |

Related Structures / Structural Developments

The growth of the sukuk market has led to the development of a number of ‘hybrid’ structures around the sukuk al-ijara model in order to provide additional flexibility - particularly when selecting underlying assets. A few of these developments are summarised below:

- In order to enable investors to receive compensation where an asset is still under construction, certain Shari’a scholars have permitted the use of the forward lease arrangement (known as ijara mawsufah fi al-dimmah). This forward lease agreement is normally combined with an istisna contract (or procurement agreement), under which construction of the asset is commissioned. This structure is discussed in more detail later in this Chapter 2 (Sukuk Structures) at Part 5: Sukuk al-Istisna; and

- If legal and/or registered title to a particular asset exists and (due to, by way of example, the prohibitive cost implications or tax implications of registering such a transfer of title) it is not possible to transfer that legal / registered title, certain structures have been approved that allow an ijara to be put in place despite the fact that the trustee does not have outright legal ownership of that asset. For example:

- it may be possible, depending on the asset type and the view taken by the relevant Shari’a scholars, to rely upon the concept of beneficial ownership in structuring a sukuk al-ijara transaction. The sale and purchase agreement (in the sale and leaseback structure discussed above) would document the sale and transfer to the trustee of the beneficial ownership interest in the underlying asset - and such beneficial ownership interest would be sufficient to enable the trustee’s entry into the leaseback arrangements contemplated in the example above;

- where the usufruct of an asset is recognised by the underlying legal and regulatory regime, it may be possible to create different categories of usufruct and for the sale of a usufruct to be relied upon for the Related Structures / Structural Developments 19 purposes of structuring a sukuk alijara transaction. An example of this is through the grant of a musataha interest (a right in rem), the holder (or musatahee) is given the right to use and develop land with such rights over that land in a manner that allows the holder to be the outright owner of the buildings constructed on that land during the period of the musataha. It should however be noted that a musataha provides an interest less than freehold or absolute ownership. The musataha right, when created, is granted by the owner of the freehold property to the holder. The right, while not a leasehold interest, is quite similar to a leasehold interest. Certain Shari’a scholars consider this sufficient to enable the holder (or musatahee), in turn, to lease the land and any buildings thereon to the originator under an ijara arrangement. Basically, a musataha contract replaces the sale and purchase agreement in the sale and leaseback structure discussed above; and

- it is also possible for a head-lease arrangement to be used instead of the sale and purchase agreement (in the sale and leaseback structure discussed above), such that the trustee is granted a long-term right to use an asset under the headlease, thus allowing the trustee to enter into a sub-lease (the ijara).

Source: Dubai International Financial Centre Sukuk Guidebook. Republished with permission.