Hawalah-based financing

Propindo Islamic Cooperative

One notable example of Hawalah-based financing can be found in Propindo Islamic Cooperative, Indonesia. It can be utilised in the trading sector involving Islamic Financial Institutions (IFI), especially Islamic microfinance institution. Hawalah-based financing has been introduced by Cooperative, an independent Islamic cooperative pioneered by a group of small traders in Jakarta Indonesia (Dewi and Kasri, 2011). In relation to that the Cooperative aim to provide additional working capital for their Small Medium Enterprise (SMEs) members because the SMEs usually receive payment within 1-3 months for the goods’ supplied. At the same time, the SME requires sufficient working capital in order to continue productions while waiting for the payment from the partner. This situation creates additional burden for SME in maintaining their business sustainability. Therefore, Hawalah-based financing is provided by the Cooperative to counter the problem.

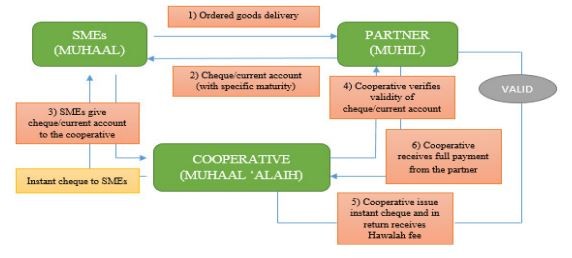

Basically this mechanism involve three parties: the partner is principal debtor, the Cooperative is the transferee, and SME is the creditor. The scene starts when debt created between the partner (principal debtor) and SME (creditor). Hawalah take place when SME transfer their debt to the cooperative. The cooperative then provides cash, based on the SME receivables values, and later collect the receivables from the partners (SME trading partner). Thus, the cooperative acts as a third party that takes over the SME’s receivables and provides ‘quick cash’ for working capital for the SME. In return, cooperative receives hawalah fee from the SME. A clear illustration of the transaction can be seen in the diagram below.

The transaction flow of Hawalah-based financing

The above figure shows transaction flow of Hawalah-based financing works between the three parties involved and the explanation is as follow:

1) SME supply particular goods to the partner.

2) After checking quality and quantity of the ordered goods, the partner issues term payment cheque that can be cashed within a particular period.

3) The SME pass the current account to the Cooperative.

4) SME will then check the originality and validity of the financial instrument issued.

5) The Cooperative issues cheque that can be disbursed and used by the SME as working capital. In return, it receives fee (ujrah) from the service provided based on agreements with the SME.

Shariah issues in Hawalah-based financing

The Shariah issue that can be identified is that the risk of non-compliance arises as there is lack of clarity in defining and setting percentage of fee proposed in the transaction. While it is allowed to take some fee, strict Shariah position requires this fee to be justified with the real costs to deliver the service. It is possible that clients may take advantage of this condition and delaying payments to the banks.

Source: Service Based Contract Used in Islamic Finance: A Comparison of Hawalah, Wakalah, and Kafalah, Maryam Sofia Mohd Suhaimi

Search our Resources or Dictionary

Islamic Economics and Economics

Rate Of Return as a Discount Rate Under Uncertainty

Additional Methods for Dealing with Uncertainty in Project Evaluation

Address on Monetary & Fiscal Economics of Islam

Allocation of Risk Through Mudarabah

An Appraisal of Monetary Policy

An Islamic Perspective on Discounting

Basic Features of Islamic Economics

Behavioral and Institutional Setting

Capitalist Accumulation or Globalization

Capitalist System: Some Deficiencies

Changes Taking Place in Conventional Economics

Characteristics of an Islamic Economy

Collapse of Communism & Rise of Capitalism

Commentary on Monetary Policy in an Islamic Economy

Comments on Current Islamic Banking

Comments on Discounting of in Project Evaluation

Comments on Fiscal Policy in an Islamic Economy

Comments on Risk-Bearing & Profit-Sharing in an Islamic Framework

Comments on the Elimination of Interest from Economic and Finance System

Comments on the Financial and Monetary Structure for an Interest Free Economy

Comments on the Foundations of Taxation Policy

Comments on the Objectives of Fiscal Policy

Comments on the Rate of Capitalisation in Valuation Models in an Islamic Economy

Comments on the Theory of Fiscal Policy

Comparison with the Welfare State

Contemporary Economic Challenges & Islam

Contrasting Islamic & Marxist Positions on Discounting

Contributions in Eighties & Nineties

Conventional Economics & its Drawbacks

Desirable Strategy for Isalmization

Discount Rate in the Theory of Corporation Finance

Discounting for Public Projects

Discounting Under Uncertainty for a Private Investor

Discussion on the Financial and Monetary Structure for an Interest Free Economy

Discussion on Current Islamic Banking

Discussion on Discounting of in Project Evaluation

Discussion on Fiscal Policy in an Islamic Economy

Discussion on Monetary Policy in an Islamic Economy

Discussion on Risk-Bearing & Profit-Sharing in an Islamic Framework

Discussion on the Elimination of Interest from Economic & Finance System

Discussion on the Foundations of Taxation Policy

Discussion on the Objectives of Fiscal Policy in an Islamic State

Discussion on the Theory of Fiscal Policy

Distinguishing Characteristics of an Islamic Economy

Distributional Implications of Interest Receipts & Payments of the Government

Economic Integration: Islamic Approach

Eliminating Interest from Loans to Provincial Governments and other Government Agencies

Elimination of Interest: Pakistan

Evaluating the Proposals to Eliminate Interest from Government Transactions: Pakistan

Facing Globalization: Setting the Muslim Mindset, Malaysia

Financing Government Transactions in an Interest-Free Economy

Financing Govt Transactions in An Interest-Free Economy: A Case of Pakistan

Fiscal Policy & Allocation of Resources

Fiscal Policy & Economic Stabilization

Fiscal Policy & Income Distribution

Fiscal Policy in an Islamic Economy

Fiscal Policy, Economic Growth & Development

Generating Research Priorities

Globalization & a Universal Approach

Globalization & its Significance

Globalization Domination of Finance

Globalization The US and the World Dollar

Globalization: Blessing or Blarney?

Globalization: MNCs & TNCs: Their Role & Socio- Economic Impact on Host Societies

Globalization: Role for Muslims

Globalization: Some Ground Realities

Globalization: Some Ground Realities & an Islamic Response

Globalization: Some Reflections

Government Expenditures on Interest: Pakistan

Growth, Stability & Resource Allocation

Higher Education & Research: Trends & Challenges in a Globalized World

Human Financial Needs & their Fulfillment

Impact & Achievements: Tabung Haji

Imperialism Today & Globalisation

Imperialism, Capitalism, Technology & Science

Implicit Strategy for Islamization

Inaugural Address on Monetary & Fiscal Economics of Islam

Interaction with Shari‘ah Scholars & Economists

Interest Payment to State Bank of Pakistan

International Financial Stability: The Role of Islamic Finance

Islamic Economics & Shari’ah Sciences

Islamic Economy: Three-Sector Model

Islamic Financial System: Malaysia

Islamic Tradition in Economics

Islamization of Finance Sector: Pakistan

Issues, Problems and Strategy: Riba

Journey From Equality To Impoverishment

Keynote Address on Monetary & Fiscal Economics of Islam

Legislative Changes in Islamic Finance

Malaysian Muslim Malaise: Globalization

Measures of Fiscal Policy in an Islamic Economy

Minimising the Budget Deficit: Pakistan

MNCs & TNCs: Emergence, Stakes & Strategy

MNCs: Impact on Host Societies

Monetary Policy in an Islamic Economy

Moral & Ethical Dimension: MNCs & TNCs

Muslims' Preparedness for Globalization

Nature and Content of Islamic Economics

Necessary New Mindset: Globalization

Need for Justice, Mutual Help & Cooperation: Islamic Approach

New World Order & Globalizaton

Objectives & Instruments of Monetary Policy

Objectives of Fiscal Policy in an Islamic Economy

Permissible vs Forbidden Discounting

Positive Time Preference as Basis for Discounting

Poverty from the Wealth of Nations

Practical Options for Central & Commercial Banking

Principle of Inclusion & Exclusion

Required Rate of Return in an Islamic Economy

Risk Allocation & Productive Efficiency

Risk-Bearing & Profit-Sharing in an Islamic Framework: Some Allocational Considerations

Self-Reliance & Elimination of Riba

Seminar Address on Monetary & Fiscal Economics of Islam

Shadowy Argument for Using a Shadow Interest Rate

Size of Interest Receipts and Payments: Pakistan

Social Integration with Cultural Diversity: Islamic Approach

Sources of Finance for Present Muslim States

State of Economic Disparity & its Reason

Stochastic Productivity of Investment as Basis for Discounting

System Constraints on Taxation

The Contemporary Scene of Economics

The Core Issue & its Redressal

The Knowledge-Based Economy: Malaysian Response

Theory & Practice of Interest-Free Banking

Theory of Income Determination

Theory of Islamic Economic: The Future

Theory of Islamic Economics: Essentials

Three Levels of Interventions: MNCs & TNCs

Unification of Mankind & Globalization: Islamic Approach

Values & Markets in Islamic Allocation

Way Ahead for Muslims: Globalization

Workers’ Participation in the Income Risks of the Firm

Pakistan Supreme Court Challenges

Pakistan Supreme Court Response to Challenges

Issues in Pakistan Supreme Court Response

Evaluation of Pakistan Banking Changes

Legal and Practical Constraints: Tabung Haji

Legal Reforms In Pakistan: 1979-89

Issues of Implementation: Zia’s Nizam-i-Mustafa

Structural Reforms in Pakistan's Legal System

Procedural Reforms: The Qanoon-i-Shahadat

Benazir Bhutto & Islamic Reforms

The Status of Women in Pakistan

Social & Political Costs: Zia's Reforms

Repugnancy to Islam - Who Decides?

Zia's Raj: The Politics of Prudential Islamization

The Objectives Resolution & Pakistan’s Constitutions

Objectives Resolution: The Argument

Relevant Case Law, For & Against: Supra-Constitutionality

Pre-Emption & Land Reforms: 1978-92

The Fate of Tenants' Right to Pre-emption: Pakistan

Raising the Ceiung: Fate of Land Reforms

Judicial Activism After Zia: Riba Elimination

Educating the Public on the Merits of Interest-free Economy

Objectives Resolution and Riba

The Faisal Case: Findings and Implications

The Variables and Nonvariables in Legal Thought

The Secularized Muslim Elites' Dilemma

Implementation of Hudood Ordinances

Types and Disposition of Cases

Region and the Hudood Ordinances

Gender and the Hudood Ordinances

Social Aspects & Environmental Concerns

Global Peace & Justice: An Islamic Perspective

Global Peace & Justice: The Christian Perspective

Development of Modem International Law in the West

Socio-Economic Justice: its Place in Islam

Justice in Pakistan & the Muslim World

Justice: The Role of Moral Values, Government & the Hereafter

Democracy & Justice in the Muslim World

Legal Framework for an Islamic Financial System

Review of Pakistan Federal Shari’ah Court Judgement on Riba

Islamic Law of Contracts and Gharar

Selection Criterion for Shari’ah Advisory

Shari’ah Aspects of Salam Contract

The Financial Market Instruments

The Financial Market & Equilibrium

Indexation of Bank Deposits & Advances

Financing on Normal Rate of Return

Methods to Finance Alternative Mechanisms

Alternative Mechanisms to Replace Riba

Specialised Financial Institutions: Pakistan

Central Banking & Monetary Policy: Pakistan

Government Transactions: Pakistan

Interim Report on Elimination of Interest

Malaysian Islamic Financial Landscape

Islamic Financial Intermediaries: Malaysia

Non-bank Islamic Financial Intermediaries: Malaysia

Malaysian Authorities & Islamic Banking

Genesis of Islamic Banking in Bangladesh

Role of Bangladesh Central Bank

Legal and Practical Constraints: Bangladesh

Achievements, Impacts and Prospects: Bangladesh

Principles of Distribution of Profit to Mudarba Depositors

Current Approach to Interest-Free Financing

Participation Term Certificate

Prospects for International Transactions Without Riba

Criteria for Appraisal from the Riba Angle

Scope & Coverage of the Ahkam on Riba

Islamic Position of Foreign Exchange Transactions

International Trade: Exports and Imports

Need for Four-Pronged Effort: Riba Elimination

Selected Riba-Safe Transaction Modes

Promotion of a Riba-Safe Business Environment

International Capital Movements

International Transactions at Government Level

Theoretical Basis of Islamic Banking

Evolution of the Concept & Practices: Islamic Banking

An Early Experiment: Islamic Banking

Business Practices of Islamic Banks

Sources of Funds of Islamic Banks

Some Misconceptions of Islamic Banking

Current Status of Islamic Financial Institutions Number of IFIs

Experience of Islamic Banks: Some Conclusions

Main Conclusions Nature of Riba

Elimination of Riba: Concept & Problems

Riba & Contemporary Transactions

Riba Elimination & Foreign Loans

Achievements & Failures: Pakistan Financial System

Present State of the Islamisation of the Financial System in Pakistan

Profit-Sharing Arrangement with Depositors

Islamic Instruments for Secondary Reserves

Central Bank’s Role as ‘Lender of the Last Resort’

Inter-Bank Flow of Funds or Inter-Bank Call Money

Provident Fund Balances of the Employees

Foreign Branches of Pakistani Banks

Riba-Free Alternatives in Commercial Banking

Interest-Free Banking: A Proposal

Islamic Financial System: A Brief Introduction

Role of Mudarba Floatation’s in Pakistan’s Capital Markets

Islamic banks as financial intermediaries

Shari’ah Maxims Relevant to Islamic Banking

The Role of Shari’ah Advisors in Islamic Banking

Limits to Shari’ah board participation in the day to day business of an Islamic bank

Historical Development: Tabung Haji

Services & Operations: Tabung Haji

Fund Mobilization: Tabung Haji

Saving Procedures: Tabung Haji

Distribution of Profit: Tabung Haji

Investment Principles: Tabung Haji

Investment History: Tabung Haji

Investment in Equities: Tabung Haji

Investment in Islamic Financial Instruments: Tabung Haji

Investment in Land & Building: Tabung Haji

Investment in Shares – Criteria

Reserves in Islamic Equity Funds

Equity Funds - Guarantee of capital of the fund by the manager

Poverty: Some Points to Ponder

Child Labour: Nature, Concerns, Reasons & Elimination Measures

Concerns Raised on Child Labour

Unemployment, Underemployment & Poverty

Educational Institutions & Education System

Indifferent Attitude of Parents & Society

Absence of Any Formal Social Security Mechanism

Revamping School Education & Vocational Training

Labour Market Information System (LMIS)

Preparation of an Employment Policy

Special Focus on Poverty Alleviation

Elimination Projects & Rehabilitation of Child Labour

Other Measures to Tackle Poverty

Case Of Pakistan: Critical Issues

Welfare & Production: A Sequential Approach

Small Farmers’ Low Productivity Trap

Institutional Buildup at Grassroots

Land & Water Resources Potential

Population - Evidence from History

Factors Affecting Poverty in Pakistan

Broad-Basing of Growth for Poverty Reduction

Inflation and Poverty Alleviation

Tax structure, Public Expenditures & Poverty Alleviation

The Existing Poverty Situation

Poverty in an International Context

Growth, Employment & Poverty Alleviation

Trends in Rural & Urban Poverty: Pakistan

Growth & Unemployment in Historical Perspective

Growth, Poverty & Unemployment Scenarios

An Evaluation of Public Strategies & Policies

Functional Income Distribution & Poverty

Growth of Employment in Pakistan

Public Expenditure & Income Transfers

Strategy for the Future: Pakistan

Non-Farm Loans in Rural Sector

Pakistan Poverty Assessment: The World Bank Document

The World Bank's Casual Approach

The Question of Policy, Poverty and Society

Government of Local Elite (Shurafa)

Poverty Alleviation & Social Action Programme

Poverty Alleviation Role of NGOs

Role of NGOS in State, Economy & Society

The Role of NGOS in Poverty Alleviation

Productive Empowerment of the Poor

Poverty Alleviation & Income Distribution – The Malaysian Way

Poverty and Economic Inequality: Malaysia

Progress in Poverty Eradication: Malaysia

Progress in Income Distribution: Malaysia

Planning for Growth and Equity: Malaysia

The Future – Vision 2020: Malaysia

Grameen Bank: An Innovative Project

Historical Perspective Reference to the Ottoman Case

Business Partnership: Ottoman Case

Prohibition of Barter & Pilgrimage: Ottoman Case

Poverty in Developing Countries (1985)

Magnitude of Poverty in the Muslim World

Zakah: Remedy for Poverty in Islam

Role of Zakah in Combating Poverty

Islamic Development Bank: Role in Member Countries

The Impact of Zakah & Ushr: Pakistan

Impact of Zakah & Ushr on Poverty Alleviation

Contribution of Zakah & Ushr to the Average Disposable Income of Lower-Income Deciles

Zakah and Ushr System: A Review

Cash Waqf: Shafi’i & Hanbali Positions

Cash Waqf: The Shi’ite Position

Original Capital of Endowment (corpus)

Centralization of the Waqf System

Waqf Centralization: Ottoman Empire & Turkey

Waqf Crisis: Late Ottoman Era and the Republic

Survival & Restoration of Waqfs in Turkey

Beneficiaries & the Family Waqf

Cash Waqfs in the Ottoman Economy

Cash Waqfs in Malaysia and Singapore

Decline of the Ottoman Cash Waqfs

Egyptian Waqfs Under the Mamluks

Egyptian Waqfs Under the Ottomans

Waqf Administration in Malaysia

Waqfs During The Turkish Republic

Central Waqf Act, 1954 (India)

Waqfs in Malaysia and Singapore

Waqfs in Pakistan & Bangladesh

Comments on Pakistan Supreme Court Judgement on Riba & Tabung Haji

Islamic Derivatives: Paradox or Panacea?

Islamic risk management: types, trends & issues

Islamic Banking Services in Malaysia

Integrating Money in Capital Theory

Mosa’qaat Contract in Islamic Finance

Direct Investment and Islamic Syndication

Properties of Money in Islamic and Conventional Settings and the Effect on Society

Classification of Islamic Modes of Contract

Capitalist vs Islamic Economic System

Islamic Banking Can Save Capitalism (Part 1)

Islamic Banking Can Save Capitalism (Part 2)

The Role of the Central Bank in Islamic Banking

Sukuk and Tawarruq Contracts in Islamic Finance

Hammoudi puts the problem this way:

Direct Investment and Islamic Syndication

Salam Contract in Islamic Finance

The Jo’aalah Contract in Islamic Finance

Hire-Purchase (Leasing) in Islamic Finance

Civil Partnership in Islamic Finance

Example of the Harmful Effect of an Interest-Based Economy (United States)

Mozara’ah Contract in Islamic Finance

Going Back to the Basics with Islamic Finance

Istisna’a Contract in Islamic Finance

Society and Cooperation in Islam: Incentives and Consequences

Speculation, Uncertainty, Interest, and Unemployment

Conventional Bank as Loan House vs Islamic Bank as Finance House

Islamic Money and Banking: Integrating Money in Capital Theory

IRR (Internal Rate of Return) and Investment Project Appraisal

How Islamic banking narrows the gap between the rich and poor

A Legal Perspective Towards Islamic Finance

Money and Capital Reconsidered

Speculation and on Demand for Money in an Islamic Economy

Introduction to Islamic Economic System

The importance of the economic goals

The real nature of wealth and property

Difference between Islam, Capitalism and Socialism

Factors of Productions in Islam: Capitalist View

Factors of Production: The Socialist View

Factors of Production: The Islamic View

Distribution of Wealth in Islam

Definition and classification of Musharakah

Rules & Conditions of Shirkat-ul-Aqd

Uses of Musharakah and Mudarabah

Basic mistakes in Murabahah Financing

Features of a Conventional Bank