Sukuk al-Musharaka

Prior to the AAOIFI statement in 2008 (the “AAOIFI Statement”), one of the more commonly used sukuk structures was that of sukuk al-musharaka. However, following on from the AAOIFI Statement criticising the use of purchase undertakings in sukuk al-musharaka structures (as further discussed below under the heading “AAOIFI’s Statement of 2008”), the popularity of this structure has declined in recent times.

The term musharaka is derived from the word shirkah, which means partnership. In its simplest form, a musharaka arrangement is a partnership arrangement between two (or more) parties, where each partner makes a capital contribution to the partnership (i.e. to the musharaka), in the form of either cash contributions or contributions in kind. Essentially, a musharaka is akin to an unincorporated joint venture but may, if required, take the form of a legal entity. The musharaka partners share the profits of the musharaka in pre-agreed proportions and share the losses of the musharaka in proportion to their initial capital investment.

Musharaka arrangements can be structured in a number of different ways; however, in practice the following two structures are utilised for the purposes of issuing sukuk. These are:

- Shirkat al-’Aqd – commonly referred a. to as the ‘business plan’ musharaka; it is an arrangement pursuant to which the Originator and the Trustee agree to combine their efforts and resources (typically in the form of cash and/or other asset from the Originator and the Trustee) towards a common objective; and

- Shirkat al-Melk – commonly referred to b. as the ‘co-ownership’ musharaka; it is an arrangement pursuant to which either (i) the Originator and the Trustee contribute cash to the musharaka to purchase an asset together or (ii) the Originator sells an ownership interest in an asset to the Trustee as a result of which the Originator and the Trustee become co-owners of that asset.

When structuring a sukuk issuance pursuant to a shirkat al-melk structure, the first step is often to analyse what exactly the business of an originator entails and what assets (if any) are available to support the issuance of sukuk. At the outset, if it is not possible to identify a tangible asset that is capable, from a legal and Shari’a perspective, of being contributed to the musharaka itself, it will be necessary to consider the shirkat al-’aqd structure (as well as those outlined in the rest of this Chapter 2 (Sukuk Structures)).

All sukuk structures rely upon the performance of an underlying asset or arrangement in order to generate returns for investors. The musharaka is no different in this respect and can be implemented in a manner that provides for regular payments throughout the life of the sukuk, together with the flexibility to tailor the payment profile - and method of calculation - in order to generate a profit. These characteristics make musharaka relatively straightforward to adapt for use in the underlying structure for a sukuk issuance.

One example of a sukuk al-musharaka issuance listed by an originator on NASDAQ Dubai is the Jebel Ali Free Zone FZE AED7,500 million sukuk issued in November 2007, where Clifford Chance LLP acted as legal counsel to the originator.

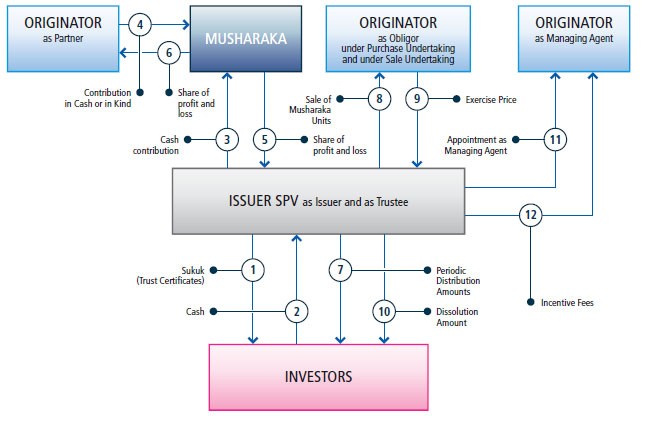

Set out below is an example of a sukuk al-musharaka structure, based upon a shirkat al-’aqd arrangement.

Figure 1: Structure of Sukuk al-Musharaka (based upon a shirkat al-’aqd arrangement)

Overview of Structure

Trustee will sell, and Originator will buy, all of Trustee’s units in the musharaka at the applicable Exercise Price, which will be an amount equal to the Trustee’s share in the fair market value of the Musharaka Assets at the time of sale. The Exercise Price will be used to pay the Principal Amount plus any accrued but unpaid Periodic Distribution Amounts owing to the Investors.

Pre-AAOIFI’s Statement, the Exercise Price was often fixed at the outset to be an amount equal to the Principal Amount plus any accrued but unpaid Periodic Distribution Amounts owing to the Investors. However, following on from the AAOIFI Statement the general Shari’a position is that where the Originator and the purchaser under the Purchase Undertaking are the same entity, the Exercise Price cannot be fixed in this manner and must instead be determined by reference to the market value of the Musharaka Assets at the time of sale (please see the section below under the heading “AAOIFI’s Statement of 2008” for further information). As a result of this, there is a risk that the Exercise Price will be less than the amount required to pay the Principal Amount and all accrued but unpaid Periodic Distribution Amounts owing to the Investors. In order to mitigate this risk, additional structural enhancements can be incorporated into the structure including (i) the maintenance of a reserve account into which excess profits from time to time during the life of the sukuk are held and used to make up any shortfalls in any payments due to Certifcateholders; and/or (ii) the option of a third party providing Shari’a-compliant liquidity funding to fund any shortfalls in any payments due to Certifcateholders (see the section below headed “Key features of the Underlying Structure” for further detail). These mitigants do not however address all the risks associated with an exercise price linked to market price of the assets.

- Issuer SPV issues sukuk, which represent an undivided ownership interest in an underlying asset or transaction. They also represent a right against Issuer SPV to payment of the Periodic Distribution Amount and the Dissolution Amount.

- The Investors subscribe for sukuk and pay the proceeds to Issuer SPV (the “Principal Amount”). Issuer SPV declares a trust over the proceeds (and any assets acquired using the proceeds – see paragraph 3 below) and thereby acts as Trustee on behalf of the Investors.

- Trustee enters into a musharaka arrangement with Originator, pursuant to which Trustee contributes the proceeds from the issuance of the sukuk into the musharaka and is allocated a number of units in the musharaka in proportion to its capital contribution.

- Originator enters into a sale and purchase arrangement with Trustee, pursuant to which Originator agrees to sell, and Trustee agrees to purchase, certain assets (the “Assets”) from Originator.

- On each periodic distribution date Trustee shall receive a pre-agreed percentage share of the expected profits generated by the Musharaka Assets and, where the Musharaka Assets generate a loss, Trustee shall share that loss in proportion with its capital contribution to the musharaka. Trustee’s share of profits will typically be a percentage high enough to at least equal the Periodic Distribution Amounts payable under the sukuk.

- On each periodic distribution date Originator shall receive a pre-agreed percentage share of profits generated by the Musharaka Assets and, where the Musharaka Assets generate a loss, Originator shall share that loss in proportion with its capital contribution.

- Issuer SPV pays each Periodic Distribution Amount to the Investors using the profit it has received from the Musharaka Assets.

- Upon:

- an event of default or at maturity (at the option of Trustee under the Purchase Undertaking); or (ii)

- the exercise of an optional call (if applicable to the sukuk) or the occurrence of a tax event (both at the option of Originator under the Sale Undertaking),

- Payment of Exercise Price by Originator (as Obligor).

- Issuer SPV pays the Dissolution Amounts to the Investors using the Exercise Price it has received from Originator.

- Trustee and Originator will enter into a management agreement whereby Trustee shall appoint Originator as

Key Features of the Underlying Structure

- Managing Agent must operate the musharaka business and invest the Musharaka Assets in accordance with the musharaka business plan that will have been agreed between the partners and will have been tailored in accordance with the principles of Shari’a;

- The ratio of profit sharing must be agreed at the outset and, unlike losses, does not have to be in proportion to each partner’s capital contribution. However, it is not permissible to agree a fixed profit amount for either Originator or Trustee;

- Losses of the musharaka must be shared by the partners in proportion to their capital contributions to the musharaka;

- Any profit distributed prior to maturity or termination of the musharaka is deemed to be in advance and is treated as an “on account” payment which shall be adjusted to the actual profit Originator and Trustee are entitled to at that time;

- he musharaka must have a degree of tangibility and this tangibility (or asset- backing ratio) can vary between 33% and 50%, depending on the Shari’a scholars involved;

- There is a possibility that the profits received by Trustee on or prior to any periodic distribution date are less than the relevant Periodic Distribution Amounts. Appropriate mechanical enhancements can be incorporated into the musharaka structure to mitigate this risk. For example, surplus profits on any Periodic Distribution Dates can be held in a reserve account and amounts held in such reserve account can be drawn to fund any shortfalls in future Periodic Distribution Amounts or in the Exercise Price (as discussed above). Secondly, the provision of third-party, Shari’a-compliant liquidity funding can be accommodated into the structure to also cover any such shortfalls; although, it is important to note that any such third-party provider can only have the right, and must not be obliged, to provide such Shari’a- compliant liquidity funding. The Trustee will be under an obligation to repay the Shari’a-compliant liquidity funding from any proceeds remaining after the sukuk have been redeemed in full; and

- Both Originator and Trustee can, from a Shari’a perspective, terminate the musharaka at any time after giving notice. On termination of the musharaka, and provided that the Purchase Undertaking has not been exercised by Trustee, the tangible assets comprised in the musharaka will be liquidated and, together with the intangible assets, be distributed between Originator and Trustee in proportion to the units (or capital contribution) held by each party in the musharaka.

Required Documentation

The following documentation is typically required for a sukuk al-istithmar transaction:

| Documents | Parties | Summary/Purpose |

|---|---|---|

| Musharaka Agreement | Originator (as Partner) and Trustee (as Partner) | From Trustee’s (and the Investors’) perspective, this is the document that creates the musharaka, gives it an ownership interest in the Musharaka Assets and entitles it to a share of the profits generated by those Musharaka Assets. From Originator’s perspective, this is the document under which it receives funding |

| Management Agreement | Trustee (as Partner) and Originator (as Managing Agent) | Allows Trustee to appoint Originator to manage the Musharaka Assets in accordance with an agreed business plan. Allows Originator to implement the funding received from Trustee (and the Investors) in accordance with its business plan. |

| Purchase Undertaking (Wa’d) | Granted by Originator (as Obligor) in favour of Trustee | Allows Trustee to sell all of its units at market value in the musharaka to Originator if an event of default occurs or at maturity, in return for which Originator is required to pay the market value of those units (through an Exercise Price - please also see the section below under the heading “AAOIFI’s Statement of 2008”) which is then used to service all outstanding amounts owing to the Investors |

| Sale Undertaking (Wa’d) | Granted by Trustee in favour of Originator (as Obligor) | Allows Originator to buy Trustee’s units in the musharaka from Trustee in limited circumstances (e.g., the occurrence of a tax event), in return for which Originator is required to pay all outstanding amounts (through an Exercise Price) so that Trustee can pay the Investors |

Related Structures / Structural Developments

Shirkat al-Melk

An alternative to the shirkat al-’aqd musharaka arrangement described above is the shirkat al- melk arrangement, which broadly operates as follows:

- Either (i) Originator and Trustee both contribute cash to the musharaka for the purposes of jointly acquiring an asset, or (ii) Originator sells a portion of its ownership interest in an asset to Trustee;

- Originator and Trustee become co- owners of the relevant asset, each with an ownership interest in the whole of the asset. As a result of this, shirkat al- melk arrangements cannot be divided or unitised in the manner that shirkat al-’aqd arrangements can (as described above);

- On maturity or early dissolution due to an event of default, optional call or tax event, Trustee would sell its ownership interest back to Originator for an Exercise Price. Similar to the shirkat al-’aqd structure, pre- AAOIFI’s Statement, the Exercise Price was often fixed at the outset to be an amount equal to the Principal Amount plus any accrued but unpaid Periodic Distribution Amounts owing to the Investors. However, following on from the AAOIFI Statement the general Shari’a position is that where the Originator and the purchaser under the Purchase Undertaking are the same entity, the Exercise Price cannot be fixed in this manner and must instead be determined by reference to the market value of the Musharaka Assets at the time of sale (please see the section below under the heading “AAOIFI’s Statement of 2008” for further information). Again, as a result of this, there is a risk that the Exercise Price will be less than the amount required to pay the Principal Amount and all accrued but unpaid Periodic Distribution Amounts owing to the Investors. This risk can be mitigated by integrating additional structural enhancements into the structure including (i) the maintenance of a reserve account (as discussed above); and (ii) the option of a third party providing Shari’a compliant liquidity funding to fund any shortfalls in any payments due to Certifcateholders (see the section above headed “Key features of the Underlying Structure” for further detail ); and

- For the purposes of such an arrangement, it will also be necessary to consider what interest is being sold to Trustee (i.e. legal or beneficial). As an additional structural enhancement, the Trustee could lease its ownership interest in the Musharaka Asset(s) to the Originator in return for periodic rental payments. If such an enhancement is implemented, the points highlighted in Part 1 (Sukuk al-Ijara) of this Chapter 2 (Sukuk Structures) will also need to be considered.

Diminishing Musharaka

Where a sukuk is structured to be amortising, a diminishing musharaka arrangement can be implemented. Pursuant to this arrangement, both the Originator and Trustee must jointly own the asset and on any date on which the amortisation is to occur, Trustee would sell some of its units or part of its co-ownership interest in the musharaka asset(s) to Originator. As a consequence of such sale, Trustee’s units or ownership interest (as the case may be) in the Musharaka Asset(s) decreases over the life of the sukuk

AAOIFI’s Statement of 2008

Before the AAOIFI Statement it was possible for the Originator to grant a purchase undertaking to the Trustee and for the Exercise Price to be a fixed amount determined in accordance with a formula (and not by reference to the market value of the Musharaka Assets). The Exercise Price would therefore typically have been, in the event of a default or maturity, equal to the face amount of the sukuk plus any accrued but unpaid Periodic Distribution Amounts. The Investors were therefore ‘guaranteed’ to receive their principal investment and profit (subject to the usual risks, such as insolvency, present in any sukuk or conventional bond structure). However, under the AAOIFI Statement, Shari’a scholars have taken the view that it is not permissible for an Originator to grant a purchase undertaking to the Trustee to purchase the Musharaka Assets for any amount other than the Trustee’s share of the market value of the Musharaka Assets at the time of sale. The premise for this ruling has been that sukuk al-musharaka are analogous to equity-based instruments and therefore the partners in the musharaka must take the risk of both profit and loss. Determining the value of the Musharaka Assets by reference to the face amount of the sukuk (or by reference to a shortfall amount) is akin to a guarantee of profit and principal, which, unless given by an independent third party (i.e. anyone other than the Originator), is not permitted under Shari’a. This ruling has resulted in a significant decline in the number of sukuk al-musharaka issuances in 2008 and 2009.

For latest information and data on sukuk, see the IslamicBanker Sukuk Monitor.

Source: Dubai International Financial Centre Sukuk Guidebook. Republished with permission.