Sukuk al-Wakala

Sukuk al-wakala structure stems from the concept of a wakala which, literally translated, means an arrangement whereby one party entrusts another party to act on its behalf. A wakala is thereby akin to an agency arrangement. A principal (the investor) appoints an agent (wakeel) to invest funds provided by the principal into a pool of investments or assets and the wakeel lends it expertise and manages those investments on behalf of the principal for a particular duration, in order to generate an agreed upon profit return. The principal and wakeel enter into a wakala agreement, which will govern the appointment, scope of services and fees payable to the wakeel, if any. The relationship between the principal and the wakeel must comply with certain basic conditions, which are described below in “Key Features of Sukuk al-Wakala”.

The wakala structure is particularly useful where the underlying assets available to the originator, and which can be used to support the issuance of the sukuk, comprise a pool or portfolio of assets or investments as opposed to a particular tangible asset or assets. The wakeel thereby uses its expertise to select and manage investments on behalf of the investor to ensure that the portfolio will generate the expected profit rate agreed by the principal. While the wakala structure has some similarities with the mudaraba structure, the main difference is that unlike a mudaraba, in which profit is divided between the parties according to certain ratios, an investor via a wakala structure will only receive the profit return agreed between the parties at the outset. Any profit in excess of the agreed upon profit return will be kept by the wakeel as a performance or an incentive fee. Some of the advantages of adopting the wakala structure are as follows:

- the portfolio of assets may comprise a broad range of Shari’a compliant assets that will be selected by the wakeel for a period of time corresponding to the duration of the sukuk. The criteria for the assets that may be included in the portfolio must be set or approved by the relevant Shari’a board that issues the fatwa. However, the range of assets may be fairly broad and could include equities (which are issued by companies complying with certain Shari’a guidelines or listed on Shari’a approved indices), other Shari’a compliant assets (such as murabaha, istisna or even other sukuk – see below) or even other types of derivative products, provided they meet Shari’a guidelines.

- it allows the originator (which may also be the wakeel) to build its balance sheet by acquiring the investments comprised in the portfolio and to utilise those investments as underlying assets for a sukuk issuance.

- it enables the originator to utilise certain assets that cannot be traded on the secondary market such as murabaha and istisna contracts . These products are debt arrangements and are financial assets and, as such, they are unsuitable as underlying assets for a sukuk issuance for trading purposes. However, they could form part of a portfolio of assets, provided that at least 30%6 of the portfolio comprises tangible assets (such as ijara or equities or other asset-based sukuk). This enables the originator to mix and match different types of assets and effectively utilise those assets which, by themselves, may not comply with the tangibility criteria. Therefore, the wakala structure may be particularly useful for Islamic banks and financial institutions, which tend to have a large number of commodity murabaha and istisna contracts on their balance sheets.

Due to the structural issues relating to the wakala structure (which are highlighted below), it has not been a popular structure for sukuk issuances. As a result, there are very few recent examples of sukuk al-wakala in the market.

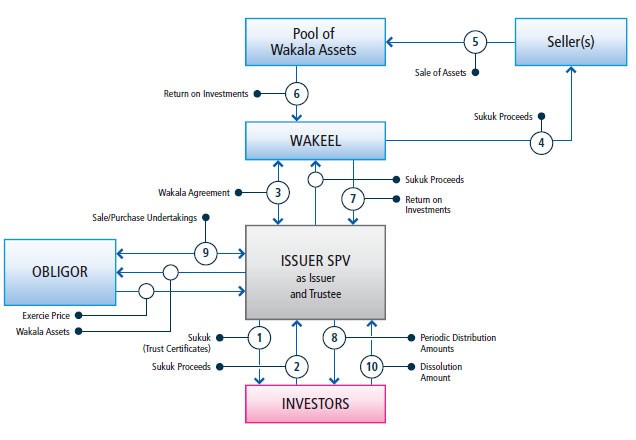

Set out below is an example of a sukuk al- wakala structure:

Figure 1: Structure of Sukuk al-Wakala

Overview of Structure (Using the numbering from Figure 8 above)

- Issuer SPV issues the sukuk, which represent an undivided ownership interest in, inter alia, the wakala assets. They also represent a right of the investors against the Issuer SPV to payments of the Periodic Distribution Amounts and Dissolution Amounts.

- The Investors subscribe for the sukuk in return for a fixed principal amount (the sukuk proceeds) payable to the Issuer SPV.

- The Issuer SPV, in its capacity as principal, enters into a wakala agreement with the wakeel pursuant to which the wakeel agrees to invest the sukuk proceeds, on behalf of the Issuer SPV, in a pool or portfolio of investments (the wakala assets), selected by the wakeel, in accordance with specified criteria.

- The sukuk proceeds will be used by the wakeel to purchase the selected wakala assets from one or more sellers.

- The wakala assets will be held and managed by the wakeel, on behalf of the Issuer SPV, for the duration of the sukuk in order to generate an expected profit to be agreed upon by the principal. The wakala assets will constitute part of the trust assets held by the Issuer SPV (in its capacity as trustee) on behalf of the investors.

- The wakala assets will generate a profit return, which will be held by the wakeel on behalf of the Issuer SPV.

- The profit return will be used to fund the Periodic Distribution Amounts payable by the Issuer SPV to the Investors. Any profit in excess of the Periodic Distribution Amounts will be paid to the wakeel as an incentive fee. It is possible that the wakala assets may generate a return that is less than the Periodic Distribution Amounts. One possible mechanism used in the past, to ensure that there are sufficient funds to make up any shortfall between the income generated by the wakala assets and the Periodic Distribution Amounts due to Investors, is for the Obligor to agree (under the purchase undertaking) to purchase a certain portion of the wakala assets at regular intervals for an Exercise Price equal to the Periodic Distribution Amounts. However, following the AAOIFI Statement, the general view amongst Shari’a scholars is that it is not permissible for an Obligor to agree to purchase wakala assets for fixed or variable amounts (calculated by reference to a formula), as this would be akin to a guarantee of profit. This mechanism would only be acceptable under AAOIFI standards if the Seller and the Obligor were different entities (see “Key Features of the Underlying Structure” below).

- The Periodic Distribution Amounts will be paid to the investors on the relevant periodic distribution dates. The Periodic Distribution Amounts will either be a fixed or variable amount calculated in accordance with a fixed formula (e.g., based upon LIBOR).

- Upon

- the maturity date or upon the occurrence of an event of default, the Issuer SPV, in its capacity as trustee will exercise its option under the Purchase Undertaking to require the Obligor to purchase the wakala assets at an Exercise Price that is equal to the Dissolution Amount payable to investors together with any accrued but unpaid Periodic Distribution Amounts.

- the exercise of an optional call (if applicable) or the occurrence of a tax event, the Obligor will exercise its option under the Sale Undertaking to buy the wakala assets from the Issuer SPV, in its capacity as Trustee, at an Exercise Price that is equal to the Dissolution Amount payable to investors together with any accrued but unpaid Periodic Distribution Amounts.

- Upon the occurrence of one of the events described in (9) above, the Issuer SPV, in its capacity as Trustee, will pay the Dissolution Amount to investors using the Exercise Price received from investors and redeem the sukuk, upon which the trust will be dissolved.

Key Features of the Underlying Structure

Set out below is a summary of the basic requirements that should be considered when using wakala as the underlying structure of the issuance of sukuk:

- The scope of the wakala arrangement must be within the boundaries of Shari’a i.e. the principal cannot require the wakeel to perform tasks that would not otherwise be Shari’a compliant.

- The subject matter of the wakala arrangement must be clear and unambiguous and must be set out in the wakala agreement i.e. the duration of the wakala, the type or criteria of assets that the wakeel can select, the fees payable to the wakeel for its services and the conditions for termination of the wakala agreement. Note that the wakeel must be paid a fee, even if nominal, in order for the wakala to be valid.

- The principal (the Issuer SPV) can only receive the expected profit, i.e., the amount used to fund the Periodic Distribution Amounts. Any excess will be held by the wakeel for its benefit.

- The wakala assets must comply with eligibility criteria. First, at least 30% of the portfolio of assets should comprise tangible assets, such as ijara or equities or other asset-based sukuk (Note: this is the minimum percentage of tangible assets as prescribed by AAOIFI. However, note that a higher threshold (in some cases, up to 51%) may be required by certain Shari’a scholars). The Originator must therefore assess whether it has a sufficient quantity of the relevant assets to satisfy this ratio. In addition, a Shari’a board would typically impose further criteria, which may include (but not be limited to) the following:

- If the pool comprises equities, the wakeel may only purchase equities of companies where the primary business activity of the company is compliant with Shari’a – for example, the wakeel may not purchase equities of companies whose primary business activity is connected with alcohol, pork- related products, gambling or other haram activities (note that some Shari’a boards may permit the purchase of equities in companies involved in such activities provided that the revenue generated from such activities only forms a very small percentage (no more than 5%) of the aggregate revenue of the company).

- The Shari’a board may impose certain financial ratios in relation to the acquisition of equities of listed and unlisted companies – this would relate to the ratio of conventional debt to equity on the company’s balance sheet. Alternatively, the wakeel may purchase equities listed on an index that has been approved as Shari’a compliant.

- If the pool comprises sukuk, the sukuk must have been approved by the relevant Shari’a board and must be fully backed by tangible assets.

- If any of the assets cease to be Shari’a compliant at any time during the duration of the sukuk, they must be removed from the pool of assets and be replaced with Shari’a-compliant assets. There must therefore be a mechanism for substituting assets. This may be achieved through the purchase undertaking or a separate substitution undertaking whereby the Obligor may be required to purchase the non-compliant asset from the pool in consideration for a new Shari’a-compliant asset.

- As mentioned above, the structure may contemplate that the Obligor shall fund payments of Periodic Distribution Amounts by purchasing certain proportions of the wakala assets for a fixed price under the purchase undertaking. However, the AAOIFI Statement has restricted the use of this mechanism to fund periodic distribution amounts except where the Obligor and the Seller are different entities and are independent of one another. Assuming that the relevant investments are held by the Obligor, those investments should first be sold to the Seller, who will in turn sell the assets on to the wakeel. However, the parties may only want an entity that is affiliated to the Obligor to act as the Seller. This may be acceptable to the Shari’a board provided that the Seller is not within the Obligor’s group.

Required Documentation

DocumentPartiesSummary / PurposeWakala AgreementTrustee (as principal) and wakeelThis document sets out the terms of the wakala, the fees payable to the wakeel, the duration of the wakala and the conditions for termination. It also sets out the eligibility criteria for the assets to be selected by the wakeel.Asset Buying AgreementSeller and wakeelOn behalf of Trustee, the wakeel will use the sukuk proceeds to purchase assets from the Seller that comply with the eligibility criteria.

Granted by Originator (as Obligor) in favour of Trustee Allows Trustee to sell the wakala assets back to Originator if an event of default occurs or at maturity, in return for which Originator is required to pay (through an Exercise Price) all outstanding amounts so the Trustee can pay the Investors.

Sale Undertaking (Wa’d) Granted by Trustee in favour of Originator (as Obligor) Sale Undertaking (Wa’d)Granted by Trustee in favour of Originator (as Obligor)Allows Originator to buy the wakala assets back from Trustee in limited circumstances (e.g., the occurrence of a tax event), in return for which the Originator is required to pay all outstanding amounts (through an Exercise Price) so that Trustee can pay the Investors.Substitution Undertaking (Wa’d) - OPTIONALGranted by Originator in favour of TrusteeTrustee may exercise its option to require the Originator to purchase any of the wakala assets that cease to be Shari’a compliant in return for new Shari’a compliant assets or cash, which will then be used to purchase new Shari’a-compliant assets. 8

Related Structures/Structural Developments

- As mentioned above, the Periodic Distribution Amounts may be funded by the Obligor purchasing a portion of the wakala assets under the purchase undertaking (for an Exercise Price equal to the Periodic Distribution Amounts), provided that the Obligor and Seller are different entities. By utilising this mechanism, the payment on the sukuk may be de-linked to the actual performance of the asset. This would also avoid certain other risks such as currency risks or the risk that the timing of payments on the investments will not match the periodic distribution dates, for which risk management mechanisms (similar to swaps) would need to be built into the structure. Instead these risks will be borne by the Obligor, which will be required to fund the Periodic Distribution Amounts (regardless of any shortfall in the income generated by the wakala assets or any currency or timing mismatches).

- Once an asset is purchased by the wakeel and included in the pool of wakala assets, it cannot be utilised by the originator, i.e., it cannot be sold or traded but must be held in the pool, until it is purchased by the Originator, through the purchase or sale undertakings. This may be undesirable from a commercial perspective, as the assets will be “locked up” for a period of time. In order to allow for some flexibility, a salam contract can be incorporated into the structure, whereby instead of the seller delivering all the Shari’a-compliant assets to the wakeel immediately upon purchase, some of the Shari’a-compliant assets can be delivered at certain specified dates in the future. Even though the purchase price is received up front, only a certain portion (which should be at least one- third of the total pool of assets) will be delivered immediately, thereby allowing the Originator to utilise its other assets, provided that it undertakes to deliver the required portion of Shari’a-compliant assets on the specified dates.

For latest information and data on sukuk, see the IslamicBanker Sukuk Monitor.

This article was originally published in the Dubai International Financial Centre Sukuk Guidebook. The article is reproduced on this website with the kind permission of the Dubai International Financial Centre (DIFC).