Sukuk al-Salam

Generally, in order for a sale to be valid under Shari’a the object forming the subject matter of the sale must be in existence and in the physical or constructive possession of the seller. The exceptions to this general position are sales effected pursuant to salam and istisna contracts.

In its simplest form, a salam contract involves the purchase of assets by one party from another party on immediate payment and deferred delivery terms. The purchase price of the assets is typically referred to as the salam capital and is paid at the time of entering into the salam contract. The assets sold under the salam contract are referred to as al-muslam fhi, delivery of which is deferred until a future date.

A salam contract may be construed as being synonymous with the objective of a forward sale contract. Forward sale contracts are generally forbidden under Shari’a unless the element of uncertainty (gharar) inherent in such contracts is effectively eradicated. For this reason, certain criteria must be met in order for a salam contract to be Shari’a compliant. These requirements are discussed in more detail below under the heading “Key Features of the Underlying Structure”.

Although the use of salam has been, and is, utilised by some institutions for short-term liquidity purposes, its use as the platform for issuing sukuk, as an alternative to conventional bonds, is rare in comparison to some of the more prevalent structures like sukuk al-ijara. The limited use of this structure can be attributed to a number of factors, namely the non-tradability of the sukuk and the requirement that the Originator must be able to deliver certain ‘standardised’ assets to the Issuer at certain future dates which may be difficult where the Originator’s business model does not provide for this.

When structuring a sukuk issuance as a sukuk al-salam, the first step will involve analysing what exactly the business of the Originator entails and what ‘standardised’ assets (if any) the Originator is able to deliver to support the issuance of the sukuk. At the outset, if it is not possible to identify any such assets, it will be necessary to consider other possible structures (including those outlined in the other parts of this Chapter 2 (Sukuk Structures)).

As with the other sukuk structures, it is possible to structure a sukuk al-salam in a manner that provides for regular payments throughout the life of a financing arrangement, together with the flexibility to tailor the payment profile - and method of calculation - in order to generate a profit. The AAOIFI Shari’a Standards perceive debt securitisation and tradability as non-Shari’a compliant. As such, although the characteristics of salam make it relatively straightforward to adapt for use in the underlying structure for a sukuk issuance, its use remains rare in practice as the salam contract creates indebtedness on the part of the seller thereby rendering these sukuk non-tradable in nature.

As at the date of this Guide no sukuk al-salam issuances have been listed by originators on NASDAQ Dubai.

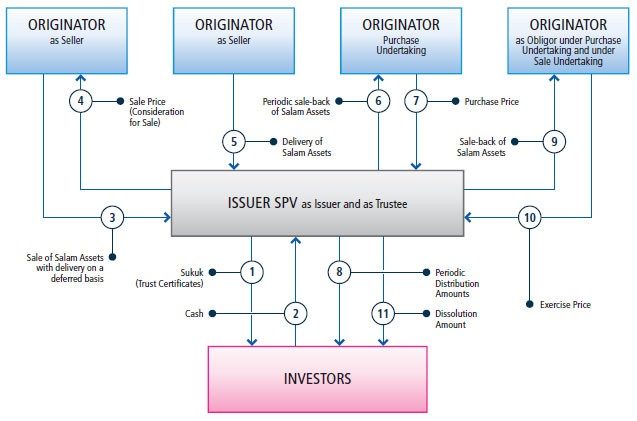

Set out on the following page is an example of a sukuk al-salam structure.

Figure 1: Structure of Sukuk al-Salam

- Issuer SPV issues sukuk, which represent an undivided ownership interest in certain assets (the “Salam Assets”) to be delivered by Originator. They also represent a right against Issuer SPV to payment of the Periodic Distribution Amount and the Dissolution Amount.

- The Investors subscribe for sukuk and pay the proceeds to Issuer SPV (the “Principal Amount”). Issuer SPV declares a trust over the proceeds (and any assets acquired using the proceeds – see paragraph 3 below) and thereby acts as Trustee on behalf of the Investors.

- Originator enters into a sale and purchase arrangement with Trustee, pursuant to which Originator agrees to sell, and Trustee agrees to purchase, the Salam Assets from Originator on immediate payment and deferred delivery terms. The quantity of the Salam Assets sold will typically be engineered at the outset to be an amount that is sufficient to make periodic deliveries of a proportion of the Salam Assets during the life of the sukuk (in order to allow for payments of Periodic Distribution Amounts, see below for further information) and to make a single delivery of the remaining proportion of Salam Assets on maturity or an early redemption of the sukuk (in order to allow for payments of the Exercise Price, see below for further information).

- Trustee pays the sale price to Originator as consideration for its purchase of the Salam Assets in an amount equal to the Principal Amount.

- Prior to each date on which Periodic Distribution Amounts are due to the Investors, Originator delivers a proportion of the Salam Assets to Trustee. Originator (as Obligor) purchases a proportion of the Salam Assets from Trustee for an agreed Purchase Price.

- Originator pays the Purchase Price as consideration for purchasing a proportion of the Salam Assets. The amount of each Purchase Price is equal to the Periodic Distribution Amount payable under the sukuk at that time.

- This amount will be calculated by reference to a fixed rate or variable rate (e.g. LIBOR or EIBOR) depending on the denomination of sukuk issued and subject to mutual agreement of the parties in advance.

- Issuer SPV pays each Periodic Distribution Amount to the Investors using the Purchase Price it has received from Originator.

- Upon

- An event of default or at maturity (at the option of Trustee under the Purchase Undertaking); or

- The exercise of an optional call (if applicable to the sukuk) or the occurrence of a tax event (both at the option of Originator under the Sale Undertaking), Originator will be obliged to deliver all of the Salam Assets (which have not yet been delivered) to Trustee and Trustee will sell, and Originator will buy, the Salam Assets at the applicable Exercise Price which will be equal to the Principal Amount plus any accrued but unpaid Periodic Distribution Amounts owing to the Investors

- Payment of Exercise Price by Originator (as Obligor).

- Issuer SPV pays the Dissolution Amount to the Investors using the Exercise Price it has received from Originator.

Key Features of the Underlying Structure

Set out below is a summary of the basic requirements based on established principles and the AAOIFI Shari’a Standards No.10 (Salam and Parallel Salam), which should be considered when using salam as the underlying structure for the issuance of sukuk:

- There must be no uncertainty between the Originator and the Issuer as to th currency, amount and manner of payment of the salam capital;

- Payment of the salam capital must be made immediately at the time of entry into the salam contract;

- The Salam Assets can only be (i) fungible goods that can be weighed, measured or counted and the individual articles of which do not differ significantly, or (ii) assets manufactured by companies that can be identified by standardised specifications and are regularly and commonly available at any time;

- The Salam Assets cannot be (i) a specific asset; (ii) gold, silver or any currency if the salam capital was paid in gold, silver or any currency; (iii) any asset or item for which the Originator may not be held responsible (e.g. land or trees); and (iv) any asset or item whose value can change according to subjective assessment (e.g. precious stones);

- The Salam Assets must be assets for which a specification can be drawn up at the time of sale so that the Originator can be held to that specification;

- The quality, quantity and time of delivery of the Salam Assets must be clearly known to the Originator and the Trustee in a manner at removes any uncertainty or ambiguity which may lead to a dispute;

- Provided that the salam capital is paid at the time the salam contract is entered into, the delivery of the Salam Assets can occur periodically by way of instalments;

- The Trustee cannot sell the Salam Assets before it has taken delivery of the Salam Assets as this would amount to the sale of a debt, which is forbidden under Shari’a. However, delivery of the Salam Assets prior to the agreed delivery date is permissible;

- The sukuk certificates held by the Investors are generally non-tradable as they represent a debt (the debt being the future delivery of the Salam Assets). This is, however, the general position. In principle, once the Salam Assets (or a proportion thereof) have been delivered and provided that as a result of such delivery the tangibility of the pool of sukuk assets at that time (i.e. the Salam Assets delivered) is sufficient to satisfy Shari’a requirements (which can vary between 33% and 50%) the sukuk can be traded at that time; and

- The liabilities associated with the Salam Assets remain with the Originator and only once the Salam Assets have been delivered to the Trustee do the liabilities pass to the Trustee

Required Documentation

The following documentation is typically required for a sukuk al-istithmar transaction:

| Document | Parties | Summary / Purpose |

|---|---|---|

| Salam Agreement | Originator (as Seller) and Trustee (as Purchaser) | From the Trustee›s (and the Investors’) perspective, this is the document which gives the right to receive delivery of the Salam Assets, which once delivered to the Trustee will be sold by the Trustee in order to generate revenue to service the sukuk. From the Originator’s perspective, this is the document under which it receives the funding |

| Purchase Undertaking (Wa’d) | Granted by Originator (as Obligor) in favour of Trustee | Allows the Trustee to sell the Salam Assets back to th Originator*: (i) periodically, prior to the date on which a Periodic Distribution Amount is due in return for which the Originator is required to pay an amount equal to the Periodic Distribution Amount (through the Purchase Price) so that the Trustee can pay the Periodic Distribution Amount to the Investors; and (ii) if an event of default occurs or at maturity, in return for which the Originator is required to pay all outstanding amounts (through an Exercise Price) so that Trustee can pay the Investors. |

| Sale Undertaking (Wa’d) | (Wa’d) Granted by Trustee in favour of Originator (as Obligor) | Allows the Originator to buy the Salam Assets back from the Trustee* in limited circumstances (e.g., the occurrence of a tax event), in return for which the Originator is required to pay all outstanding amounts (through an Exercise Price) so that Trustee can pay the Investors. |

Structural Developments/AAOIFI’s Statement of 2008

Before the AAOIFI Statement it was possible for the Originator to grant a purchase undertaking in favour of the Trustee whereby the exercise price would be a fixed amount determined in accordance with a formula that would ensure that the exercise price would:

- n the event of a default or on maturity of the sukuk, be equal to the par value of the sukuk plus any accrued but unpaid Mudaraba profits;

- n the event of a shortfall between any amount actually received by the Trustee from the Mudaraba enterprise and the profits received by the Trustee and the distribution amount due to the Investors, be equal to the shortfall

rather than a formula would reference the market value of the assets of the Mudaraba enterprise. The use of such purchase undertakings, in effect, ensured that the Investors were almost certain to receive their principal sukuk investment and profit (subject to the usual risks such as insolvency present in any sukuk or conventional bond structure).

However, under the AAOIFI Statement, Shari’a scholars have taken the view that it is not permissible for an Originator to grant a purchase undertaking to the Trustee to purchase the Mudaraba assets for any amount other than the Trustee’s share of the market value of the Mudaraba assets at the time of sale. The premise for this ruling has been that sukuk al-mudaraba are analogous to equity-based instruments and therefore the partners in the Mudaraba must take the risk of both profit and loss. Determining the value of the Mudaraba assets by reference to the par value of the sukuk (or by reference to a shortfall amount) is akin to a guarantee of profit and principal which, unless given by an independent third party (a party other than the Originator), is not permitted under Shari’a. This ruling is another reason why the sukuk market has not seen a revival of the sukuk al-mudaraba structure.

For latest information and data on sukuk, see the IslamicBanker Sukuk Monitor.

This article was originally published in the Dubai International Financial Centre Sukuk Guidebook. The article is reproduced on this website with the kind permission of the Dubai International Financial Centre (DIFC).