East Cameron Partners’ Sukuk

East Cameron Partners issued sukuk of US$165.67 million in July 2006 with maturity period of 13 years. This was the first sukuk issued by a company based in United States and rated by Standard & Poor’s. The underlying contract was musharakah (co-ownership/joint venture) in which sukuk investors own so called Overriding Royalty Interest (ORRI) in two gas properties located in the shallow waters offshore the State of Louisiana through an SPV acting as a trustee of sukuk holders. The SPV was called East Cameron Gac Company (ECGP) and incorporated in the Cayman Islands. The originator also contributed its funds into the musharakah. The assets of the musharakah were co-owned by the sukuk holders and the originator company East Cameron Partners. The sukuk were secured by a mortgage on the assets of the issuer, which included the ORRI and secured accounts. The sukuk were rated CCC+ by Standard & Poor’s.

East Cameron Partners Sukuk - The Originator’s Details and Purpose of Sukuk Issuance

East Cameron Partners was incorporated in Houston, Texas as a private oil and gas exploration company in 2002 and acquired leasehold interests in oil and gas production, in federal oil and gas leases administered by Minerals and Management Services of the US Department of Interior (MMS)(Boustany (2006 )). The purpose of the originator was not shariah compliant financing per se. East Cameron Partners simply saw this as an affordable and flexible finance opportunity through which it could raise the funds needed to purchase of shares from its non-operating partner, Macquarie Bank who wished to sell its share in the business. Finding limited opportunities in conventional finance, the owner of the company judged issuing sukuk a better choice.

East Cameron Partners - Sukuk Structure

The original plan was to issue an Ijarah (leasing) sukuk, but the return on the assets to be financed through the sukuk issue were not commensurate with the sukuk return deemed necessary for a successful placement of the sukuk. Therefore, the sukuk was structured as musharakah, which allowed East Cameron Partners to pay a higher return on the sukuk than the return on the shares whose purchase was to be financed through the sukuk. The difference between equity shareholding and musharakah sukuk is that the sukuk are redeemable within some time period as well as have limited recourse to underlying musharakah assets. East Cameron Partners presumably was willing to pay a premium return to its financiers because through this transaction it would get complete control of the shares after expiration of the sukuk. Ijarah sukuk would not have allowed such a financial structure.

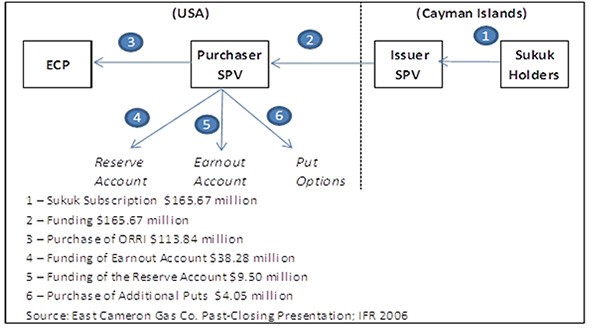

The structure of the sukuk works as follows (see Figure 1):

1. The issuer SPV, East Cameron Gas Company (ECGP), incorporated in Cayman Islands issued USD165.7 million of sukuk whose proceeds would be used to buy the ORRI from the Purchaser SPV following a Funding Agreement for USD$ 113.8 million. The remaining amount was appropriated for development plan, a reserve account and the purchase of put options for natural gas to hedge against the risk of fall in gas prices.

2. The originator contributed his share of the capital in the form of a transfer of ORRI into the purchaser SPV.

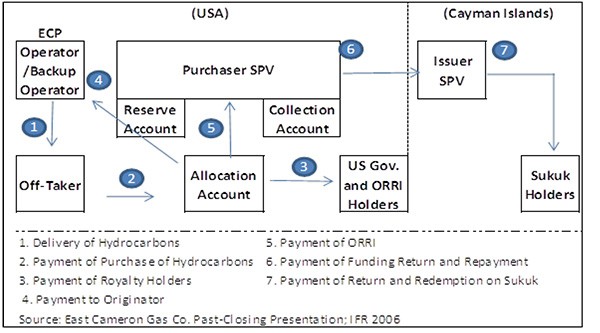

3. Next, the purchaser SPV, holding ORRI in the properties, would be entitled to around 90 percent of East Cameron Partners' net revenue generated though gas production.

4. The production would be sold to two off-takers with Merill Lynch as a backup off-taker.

5. Proceedings of the oil and gas sale would be transferred to an allocation account. After paying around 20 percent to government and private ORRI, the remaining amount would be transferred to the Purchaser SPV. Next, the purchaser SPV would allocate 10 percent for the originator and the remainder for payment of expenses, periodic sukuk returns and redemption amount. Any excess amount would go to originator and early redemption of the sukuk equally.

6. Upon maturity of sukuk, the issuer SPV would redeem all the sukuk against the amount left to be transferred to the sukuk holders.

Figure 1 - Transaction Schematic for East Cameron Partners Sukuk

Figure 2 - Transaction Schematic for East Cameron Partners Sukuk

The repayment of the sukuk was scheduled quarterly depending upon the production and sale of the hydrocarbons to the buyers. An expected return of 11.25 percent was offered to the sukuk investors, to be paid quarterly too. A reserve account was also maintained as a credit enhancement, dedicated to meet any shortfall in return with the moneys reserved in the account. Furthermore, put options were bought to acquire the right to sell the oil and gas at the strike price, thereby providing a hedge against a falloff gas prices below the strike price.

Shariah compliance of East Cameron Partners Sukuk

The East Cameron Partners sukuk can be considered as an asset backed sukuk and only that structure fulfills (most of) the requirements of shariah principles described by AAOIFI (2008).

- Ownership of the Musharakah Assets: The sukuk holders were declared as the owners of underlying assets which are claims on oil and gas reserves through registered ownership of ORRI and which are deemed as real property in the related jurisdiction.

- Credit Enhancements: Credit Enhancement was provided through an USD9.5 million reserve account which is in accordance with the shariah principles mentioned by AAOIFI 2008.

- Put Option: Although Sukuk structure use conservative commodity price projections there could be fluctuations in the oil and gas market price. To mitigate downside price risk, commodity price hedges are often put in place. Moreover, a backup offtake agreement was made with Merril Lynch to hedge the risks related to demand for gas production.

Restructuring the East Cameron Partners Sukuk

East Cameron Partners, the originator company, defaulted on periodic payments to the sukuk holders not because of low prices but due to financial problems arising from the shortfall in oil and gas production triggered by damage after a Hurricane in the area in September 2008. On 16 October 2008, East Cameron Partners, the originator, filed a petition for bankruptcy protection under chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court in Louisiana to reorganize their debts and operations.

Also, East Cameron Partners filed ‘adversary proceedings’ and requested the court to consider the primary sukuk transaction with the purchaser SPV as ‘secured loans’ and not as ‘true sale’ of assets (McMillen (2011 )). This would imply that sukuk holders were to share the assets with other creditors of the originator in liquidation process if the transaction is considered secured loan. The bankruptcy court apparently rejected East Cameron’s argument saying that “ [sukuk] holders invested in the sukuk certificates in reliance on the characterisation of the transfer of the royalty interest as a true sale” (Fidler (2009 )). This was a very important precedent about protection of sukuk holders’ rights and would subsequently have a positive impact on sukuk growth in US since it set the precedent that asset backed sukuk are in fact bankruptcy proof, the transfer of assets to the Sukuk SPV was shown to be safe from bankruptcy of the originator company.

Then, East Cameron Partners filed a revised lawsuit but, subsequently the stakeholders preferred to resolve the case through negotiations. Finally, the underlying sukuk assets were transferred to the issuer for the benefit of sukuk investors. According to the terms of the sale the assets of East Cameron Partners were sold to the Sukuk investors (Latham and Watkins (2011 )). But the originator was given a subordinated ORRI on future production, which would contain some value once the principal amount of sukuk holders have been repaid. In a sense the originator received a call option on its own assets with as strike price the the principal amount of the sukuk. Thus in the US, sukuk holders’ rights are protected due to a well-developed legal system of collateral and recognition of all the contracts by the courts of law. Then situation in the GCC countries turned out to be very different, as will become clear from some of the other case studies.

For latest information and data on sukuk, see the IslamicBanker Sukuk Monitor.

This Case Study was originally published in "Sukuk Defaults: On Distress Resolution in Islamic Finance", Sweder van Wijnbergen and Sajjad Zaheer, July 2013.