Gharar

Gharar has meanings that encompass: uncertainty, risk, hazard and deceit. The Arabic root for gharar means deception - but in practice the term is used quite widely.

Gharar is an important concept in Islamic finance, with most derivative products rejected by sholars due to excessive uncertainty.

According to Al-Qarafi, the definition of gharar is "that which has a pleasant appearance and a hated essence". The origin of gharar can be divided into two categories, namely: tadlis (cheating in business) and ghabn (to deceive), as noted by the Encyclopedia of Jurisprudence (vol.21, CDROM version, Cairo: Harf, 1998).

All businesses involves some level of risk, therefore unlike riba, gharar is a relative concept when it comes to uncertainty, risk and hazard - with a certain level of uncertainty being tolerated. However, when it comes to deceit or fraud, gharar is an absolute concept.

Nature of Gharar

We already understand the seriousness of riba (interest) within Islam - with anyone dealing in such an activity facing war from God and his messenger. Two of the main reason Ibn Juzay (Maliki scholar) provides for gharar are as follows:

- Uncertainty over subject matter: sale of stray animal or "unborn calf in the mother's womb"

- Uncertainty over price: the sale of X at time t+1, where the price will also be determined at t+1

Qur'an, Hadiths and Gharar

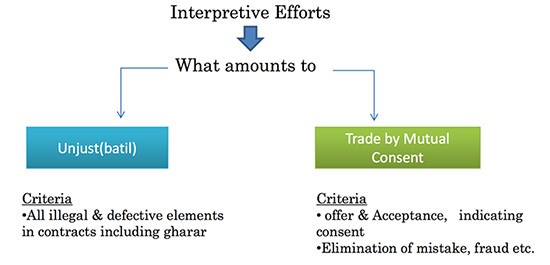

Surah an-Nisa (4:29) "...squander not your property amongst yourself unjustly (batil) except it be a trade among you by mutual consent..."

Scholars have cited numerous examples of hadiths, where gharar is prohibited. According to a strong hadith, narrated by Muslim, 'Ahmad, 'Abu Dawud, Al Tirmidhi, Al Nasa'i, Al Darami and 'Ibn Majah on the authority of 'Abu Hurayra "the Prophet prohibited the pebble sale and the gharar sale".

Other examples include:

- selling "the birds in the sky or the fish in the water",

- "the catch of the diver", "unborn calf in its mother's womb",

- "the sperm and/or unfertilized eggs of camels"

Source: INCEIF / Dr. Shahul Hameed Haji Mohamed Ibrahim

Cost benefit analysis and Gharar

We already understand that the probation of gharar is relative, another way of looking at gharar is from a cost benefit analysis, i.e. if there is a greater benefit (positive externality) then cost (negative externality), then the contract would be considered as valid. This point is reinforced by ‘Ibn Taymiya (1998, vol. 4):

In this regard, the corrupting factor in gharar is the fact that it leads to (kawnuhu mat.iyyat) dispute, hatred, and devouring others' wealth wrongfully. However, it is known that this corrupting factor would be overruled if it is opposed by a greater benefit (al-mas. lah. Ah al-rajih. ah).

Schools of thought

As noted, scholars have faced many challenges in defining gharar, with Al-Zuhaylı (1997, vol.5, pp.2408-3411): providing a good overview:

Al-Sarakhsi (Hanafi school): "gharar is that whose consequences are hidden".

Al-Shıraazı (Shafi'i school): "gharar is that whose nature and consequences are hidden"

Ibn Taymiya (Hanbali school): "gharar is that whose consequences are unknown"

Once reviewing the above definitions, Al-Zuhayly's commented: "gharar sale is any contract which incorporates a risk which affects one or more of the parties, and may result in loss of property."

Gharar: Examples

Example 1: A Single Contract with Two Sales

Gharar: Buyer accepts the offer, but without specifying the price

Acceptable Gharar: If the sale is not binding, then some scholars (e.g. Malaki) accept that this form of gharar is permissible.

Example 2: Arbun / Option Sale

Gharar: Buyer makes a downpayment and has the right, but not the obligation to buy the product / service.

Acceptable Gharar: Many sharia scholars note that arbun is an acceptable form of gharar, provided two conditions are met: a) conditions outlined and agreed from the outset; b) the structure is necessary, with no other alternative available.

Example 3: Conditional Sale

Gharar: the sale is made conditional on another uncertain event (e.g. I will buy you car, if I sell my car first).

Acceptable Gharar: Ibn Taymiyah notes that this form of sale is acceptable provided both parties benefit and it does not contradict the Qu'ran or Sunnah.

Sources & Further Reading on Gharar

- Al-Qarafı, A. n.d. Al-Furuq. Beirut: ‘Alam Al-Kutub.

- Al-Zuhaylı, W. 1997. Al-Fiqh Al-'Islamı wa 'Adillatuh. Damascus: Dar Al-Fikr. Fourth revised edition.

- 'Ibn Taymiya, A. 1998. Al-Fatawa Al-Kubra. Cairo: Harf (reprod.): Dar Al-Kutub Al-‘Ilmiyyah. in Encyclopedia of Islamic Jurisprudence (CDROM).

- M A El-Gamal, 2001 "An Economic Explication of the Prohibition of Gharar in Classical Islamic Jurisprudence"

- The Permissible Gharar (Risk) in Classical Islamic Jurisprudence: http://www.kau.edu.sa/Files/121/Files/68212_162-Al-Saati-5.pdf