Human Financial Needs & their Fulfillment

It may be useful to also briefly discuss here the human financial needs and different modes for their fulfillment. It is important, since the banking and financial institutions in their respective sectors, as enumerated above, have evolved not out of a vacuum. Instead, they have emerged to cater for human needs for specific banking and financial facilities and services. Of course, the scenario keeps on changing continuously depending on the stage and the rate of economic development of a given society. Some old needs may fade away, others may be overtaken by more sophisticated ones and totally new needs may emerge. Correspondingly, some old institutions may lose their usefulness and cease to exist, others may be remodeled and revamped and absolutely new ones may come into being.

There are many types of human needs for financial facilities and services. But we shall focus here on the category that is most pressing and universal, namely financing needs. This is the need of an economic unit for fund/capital to carry out an economic activity. The economic unit may be a household, a firm or a government entity. The economic activity may be in relation to production, distribution or consumption. In every community, from the pre-Islamic era to the period of Islam, Islamic or non-Islamic and traditional or modern, the fulfillment of financing needs has occurred in the following ways:

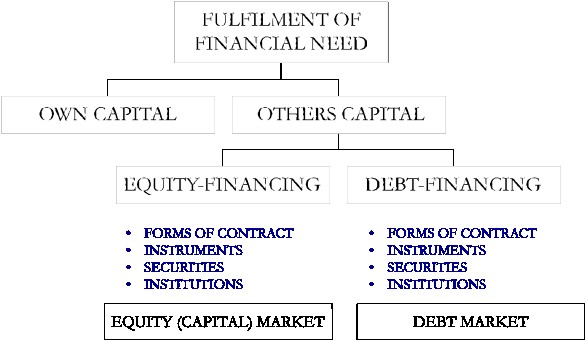

Figure 2: Human Financial Needs

The component of “own capital” is outside the scope of discussion here. But the banking and financial system and the facilities and services that it provides which we have indicated above have indeed emerged largely to cater for human needs for financing from the component of “others’ capital”. There are two types of financing from others’ capital, namely: Equity-financing and Debt-financing. In corporate finance nomenclature, these financing needs from others’ capital are also known as “external financing needs.”

Human needs fulfilled from banking and financial facilities and services create a bi-pronged financial apparatus in which while there is a giving, asset-side, another taking or a liability-side is also present. In other words, by a simple example, a bank’s facility is as much needed by a depositor in order to deposit his savings, as by a borrower in order to borrow the capital. This obviously leads to conventional banking and financial system.

Equity-financing takes place when an economic unit takes on the capital of other party in the form of equity to undertake commercial projects. The usual form of this operation is for two or more parties (including banks and financial institutions with their customers) to pool their capital to carry out the required project. The legal or formal form this process entails may be partnership, joint-stock company, or a co-operative society. Each party then has its share in the entity proportionate to its capital contributed and similarly has the voting rights (control) in the entity in the same proportion (with exception of co-operatives where one member has one vote irrespective of his capital contribution). Each party holds its share in the project either in the form of ordinary shares or preference shares and respectively receives share of profit (or dividend) in proportion to the capital contribution or as prearranged among shareholders.

As for debt-financing, one may conceive the need for it at various economic levels in the following areas:

- Consumer Financing: For residential buildings, furniture, fixtures and fittings, private vehicles, consumer durables and consumer goods.

- Domestic Trade Finance: Domestic trade, credit purchases and credit sales.

- International Trade Finance: Import trade purchase and sale credits, export trade purchase and sale credits.

- Corporate Finance: Various forms of debt components of corporate finance.

- International Finance: Public-sector foreign-debt requirements, private-sector foreign-debt requirements.

- Government Financial Operations: Treasury bills and government bonds.

It can be concluded that the needs for external financing can be met by equity-financing or by debt-financing or by a combination of both. Within each domain of equity-financing and debt-financing, modes of contract, instruments, securities and institutions usually evolve. Hence two distinct, though interrelated, markets exist side by side in the banking and financial system, namely equity or capital market and debt market.

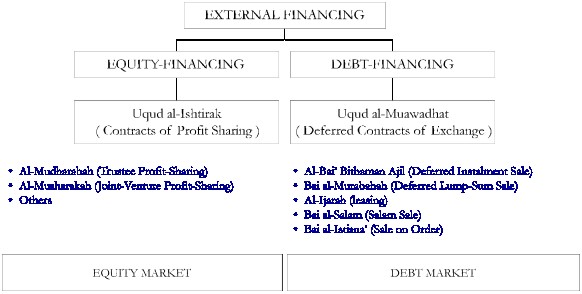

The Islamic View: The Qur’an and Sunnah form the basis of economic and financial system in Islam. Some of the Islamic practices are based on the Sunnah such as the trading activities of the Prophet (s.a.w.). These practices affirmed that the uqud al-ishtirak (profit-sharing contracts) of mudaraba, musharaka and other similar contracts (pre-Islamic era practices) are allowed in Islam. While Qur’an does not directly deal with equity-financing, it comes out strongly on debt-financing. Sunnah also deals the issue extensively allowing deferred contracts of exchange (jaiz or mubah) and forbidding interest-based lending.

To summarize, Islam allows both equity-financing and debt-financing. While equity-financing has to be effected through profit-sharing contracts, debt-financing has to be done through deferred contracts of exchange. As is shown in Figure 3 below. This is indeed the foundation for establishing and developing the Islamic banking and financial system.

Figure 3: Islamic Equity & Debt-Financing

Lending is still allowed in Islam, but it has to be without interest. In Shari‘ah, this type of lending is known as al-qard al-hasan (benevolent loan). This contract is therefore, more relevant in the social-welfare sector of the economy or where there is a social implication such as in dealing with government, rather than in the private or commercial sector of the economy.

Malaysian Financial System & Tabung Haji: The above conceptual framework provides a clear explanation on the types of investment opportunities that are available to Islamic institutions in general.

As regards to the framework of banking and financial system, different countries determine it differently and even within a single country the arrangement of its financial system dynamically evolves over time. However, for Malaysia at the present stage of its development, its financial system can roughly be figured out as comprising of the following sectors and institutions within each sector:

- Banking System: Central Bank, Commercial banks, merchant banks, finance companies, leasing companies, Money market, foreign exchange market.

- Non-bank Financial Institutions: Development banks, Industrial banks, Agricultural banks, Venture capital companies, Insurance companies, Provident and pension funds, Savings banks (including Tabung Haji), building societies, Co-operative banks, Co-operative societies.

- Capital Market: Stock exchange, Unit trust companies, Property trust companies.

- Commodity market: Commodity trading companies.

Pilgrims Management and Fund Board or Tabung Haji is an economic activity different from other muamalat institutions in that it is also indirectly linked to ibadat aspect of Shari‘ah. At Th a portion of the profit from investment activities is ploughed back to assist pilgrims perform the most sacred religious rite Hajj as complete as possible (i.e. Hajj-e mabrur). Th is committed to provide best services to pilgrims; not just physical but also the educational and spiritual support. This is a unique organization as compared to other muamalat institutions that combines the attractiveness of ibadat i.e Hajj as integral part of muamalat. The prospective pilgrims deposit their money for Hajj, while Th invests their money to garner profits to their benefit, at the same time offering comprehensive Hajj facilities so that they perform pilgrimage in the best possible manner.

From a national standpoint, Tabung Haji was devised as an economic scheme in the context of national development. Its purpose is to provide an appropriate Islamic means of mobilizing savings and preventing the fragmentation of wealth by assisting Muslims to perform the pilgrimage in Mecca without impoverishing them or further imposing any financial hardships after their pilgrimage. The other objective was to enable Muslims pool their resources to invest and participate more meaningfully in the nations economic activity. Tabung Haji’s investment activities are targeted to be consistent with the objectives of the national development policy of Malaysia.

Source: Towards Islamic Banking: Experience and Challenges, Institute of Policy Studies. Republished with permission.