Islamic Wealth Dialogues Series Launched by Maybank Islamic: Inaugural Session on Wealth Protection

December 27, 2022 | Updated at January 09, 2023

KUALA LUMPUR: Islamic finance, which follows Shariah law, can further harness the Objectives of Shariah (Maqasid al-Shariah) by utilising big data analytics and artificial intelligence, as there are commonalities between them, says esteemed Shariah scholar Tan Sri Dr. Mohd Daud Bakar.

A recipient of the Royal Award for Islamic Finance 2022, Tan Sri Dr. Daud, in his latest book titled "Maqasid Al-Shariah, The Face and Voice of Shariah," opined that relating Maqasid al-Shariah to empirical evidence, provided by data and mathematics, can drive a new Shariah thinking and reasoning process, especially among modern minds.

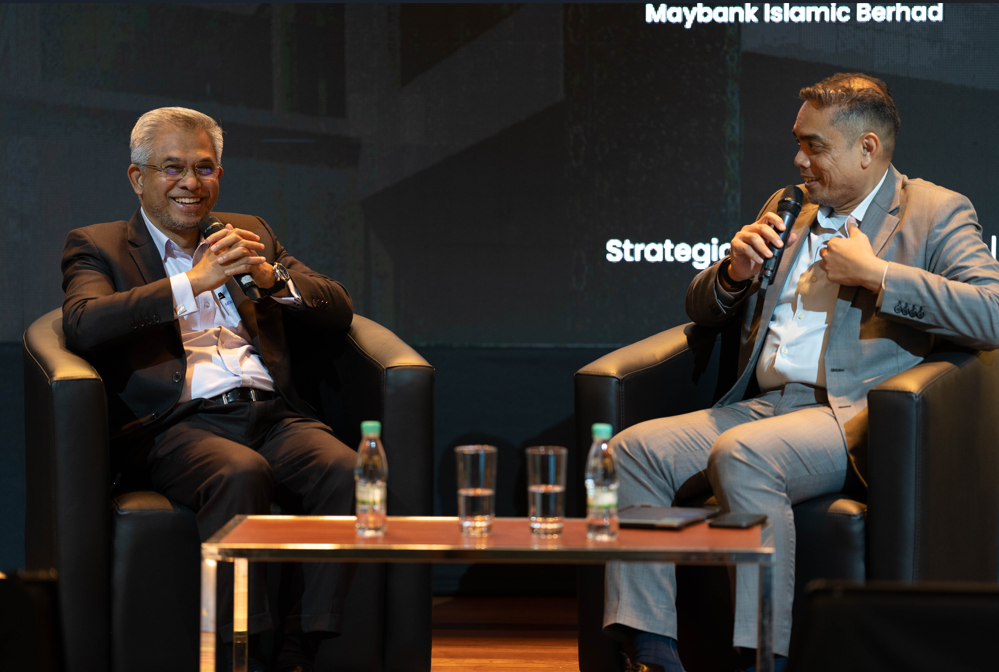

He made this statement at Maybank Islamic Berhad’s inaugural Islamic Wealth Dialogues (IWD) session, which was held recently here.

The dialogue series is initiated by Maybank Islamic Wealth Management in collaboration with IslamicMarkets Limited (IslamicMarkets), with the aim of raising awareness on wealth management and promoting financial literacy in times of uncertainty.

Tan Sri Dr. Daud shared that his book aims to provide a clear understanding and definition of Maqasid al-Shariah by acknowledging that Shariah and Maqasid al-Shariah exist in tandem.

"Knowledge must be thoroughly examined and inspected using relevant tools in order to reach a cognitive understanding. Cognitive understanding is at the heart of Maqasid al-Shariah, and this level of understanding is essential for identifying the missing themes of the Maqasid (Objectives) in the Quran," he said.

(Shariah law has a comprehensive set of principles and guidelines that include universal objectives such as managing financial transactions and wealth. Within this framework, there are several prohibitions and restrictions that aim to create a society that is fair, just, and transparent.)

Maybank Islamic’s first IWD session was attended by over 100 guests, including industry leaders who gathered at the Islamic Arts Museum here, as well as over 1,400 participants who tuned in to the live broadcast from around the globe through the leading data intelligence platform, IslamicMarkets.com.

In his speech, Maybank Islamic CEO, Dato’ Mohamed Rafique Merican said events like this are part of the Bank’s continued efforts to contribute to the growth and development of the Islamic finance industry.

“We believe that this invaluable book will be a substantial contribution towards the development and growth of the Islamic finance industry. Maybank Islamic is grounded by the realisation that we also have an opportunity to increase the awareness, as well as the furtherance of knowledge of Shariah and its objectives,” he said.

Shakeeb Saqlain, CEO of IslamicMarkets, added, "By presenting Islamic wealth management through the expertise of industry professionals, the series aims to offer a new perspective on wealth protection. This will provide stakeholders with guidance on how to safeguard assets, manage risk, and accumulate wealth.”

Moving forward, the series will feature a variety of local and international market professionals who will share insights on timely topics ranging from Wealth Creation, Wealth Accumulation, Wealth Preservation, Wealth Purification and Wealth Distribution.

To watch the recording of Islamic Wealth Dialogues and to register for future events, kindly click on: https://app.islamicmarkets.com/co/islamic-wealth-dialogues